Question: use this formula The market consensus is that Analog Electronic Corporation has an ROE = 12%, a beta of 175, and plans to maintain indefinitely

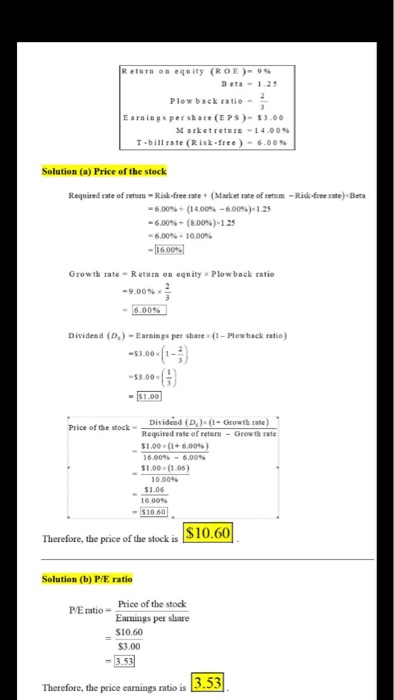

The market consensus is that Analog Electronic Corporation has an ROE = 12%, a beta of 175, and plans to maintain indefinitely its traditional plowback ratio of 1/4. This year's earnings were $2.00 per share. The annual dividend was just paid. The consensus estimate of the coming year's market return is 13%, and T-bills currently offer a 6% return a. Find the price at which Analog stock should sell (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Price $ 1825 ces b. Calculate the P/E ratio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) P/E Ratio Leading Trailing Prey 6 of 6 Next c. Calculate the present value of growth opportunities. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) PVGO 02:59:07 kopped Book d. Suppose your research convinces you Analog will announce momentarily that it will immediately change its plowback ratio to 3/4 Find the intrinsic value of the stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Print eferences Intrinsic value eturn on equity (ROE) - 99 Beta - 1.25 Plow back ratio- arningspershare (EPS) $3.00 Marketreu-14.00 Tobill rate (Risk-free) - 6.00% Solution (a) Price of the stock Required rate of retum-Risk-free rate + Market rate of retum -Rid-free rate) Beta - 6.00% + (14.00% -6,00%) 1.25 - 6.00% (8.00%) 1.25 - 6.00% +10,00% - 160096 Growth rate - Return on equity Plow back ratio Dividend (D) -Earnings per sharex (1 - Plowback ratio) -$3.00 (1-1) -$3.00 - - $1.00 Price of the stock - Dividend (D.) (1 - Growth rate) Required rate of relem - Growth rate $1.00 (1+6.00%) 16.00% - 6.00% $1.00 (1.06) 10.0046 $1.06 10.005 - $10.60 Therefore, the price of the stock is $10.60 Solution (b) P/E ratio PE ratio - Price of the stock Earnings per share S1060 $3.00 Therefore, the price earnings ratio is 3.53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts