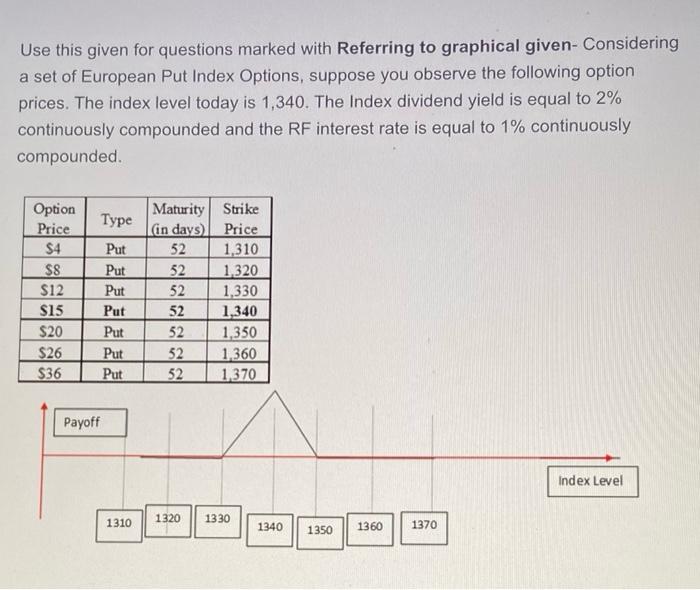

Question: Use this given for questions marked with Referring to graphical given- Considering a set of European Put Index Options, suppose you observe the following option

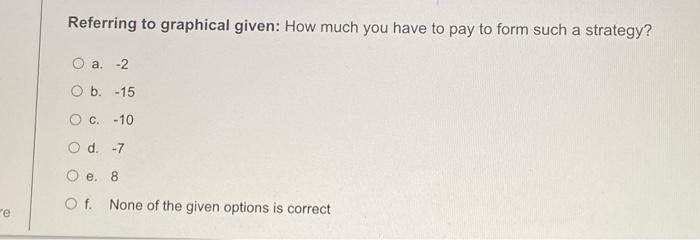

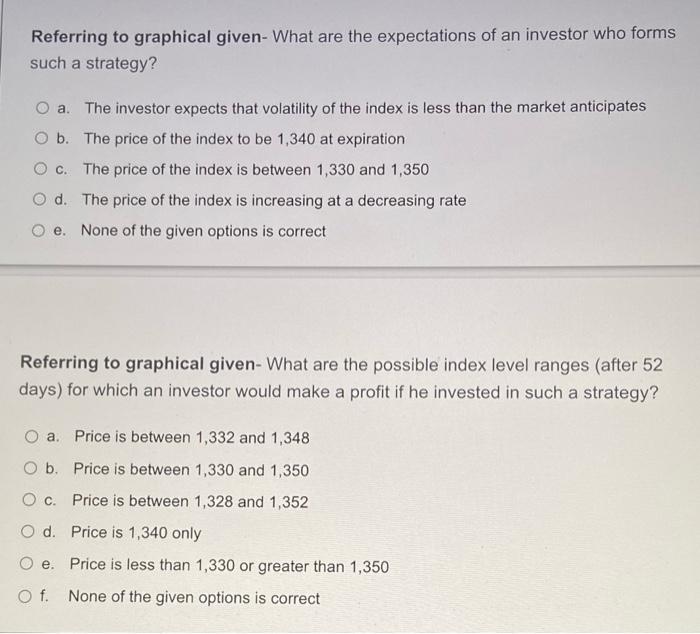

Use this given for questions marked with Referring to graphical given- Considering a set of European Put Index Options, suppose you observe the following option prices. The index level today is 1.340. The Index dividend yield is equal to 2% continuously compounded and the RF interest rate is equal to 1% continuously compounded Type Option Price $4 $8 $12 $15 $20 $26 $36 Put Put Put Maturity Strike Lin days) Price 52 1,310 52 1.320 52 1,330 52 1,340 52 1,350 52 1,360 52 1370 Put Put Put Put Payoff Index Level 1310 1320 1330 1340 1350 1360 1370 Referring to graphical given: How much you have to pay to form such a strategy? O a. 2 O b.-15 O c.-10 O d. -7 O e. 8 Of None of the given options is correct re Referring to graphical given- What are the expectations of an investor who forms such a strategy? O a. The investor expects that volatility of the index is less than the market anticipates b. The price of the index to be 1,340 at expiration Oc. The price of the index is between 1,330 and 1,350 Od. The price of the index is increasing at a decreasing rate O e. None of the given options is correct Referring to graphical given- What are the possible index level ranges (after 52 days) for which an investor would make a profit if he invested in such a strategy? O a Price is between 1,332 and 1,348 O b. Price is between 1,330 and 1,350 O c. Price is between 1,328 and 1,352 Od Price is 1,340 only O e. Price is less than 1,330 or greater than 1,350 of None of the given options is correct Referring to graphical given- What is the maximum profit that an investor can achieve per unit of this strategy? O a. 8 O b. 10 O c. 12 O d. 15 Oe. None of the given options is correct Use this given for questions marked with Referring to graphical given- Considering a set of European Put Index Options, suppose you observe the following option prices. The index level today is 1.340. The Index dividend yield is equal to 2% continuously compounded and the RF interest rate is equal to 1% continuously compounded Type Option Price $4 $8 $12 $15 $20 $26 $36 Put Put Put Maturity Strike Lin days) Price 52 1,310 52 1.320 52 1,330 52 1,340 52 1,350 52 1,360 52 1370 Put Put Put Put Payoff Index Level 1310 1320 1330 1340 1350 1360 1370 Referring to graphical given: How much you have to pay to form such a strategy? O a. 2 O b.-15 O c.-10 O d. -7 O e. 8 Of None of the given options is correct re Referring to graphical given- What are the expectations of an investor who forms such a strategy? O a. The investor expects that volatility of the index is less than the market anticipates b. The price of the index to be 1,340 at expiration Oc. The price of the index is between 1,330 and 1,350 Od. The price of the index is increasing at a decreasing rate O e. None of the given options is correct Referring to graphical given- What are the possible index level ranges (after 52 days) for which an investor would make a profit if he invested in such a strategy? O a Price is between 1,332 and 1,348 O b. Price is between 1,330 and 1,350 O c. Price is between 1,328 and 1,352 Od Price is 1,340 only O e. Price is less than 1,330 or greater than 1,350 of None of the given options is correct Referring to graphical given- What is the maximum profit that an investor can achieve per unit of this strategy? O a. 8 O b. 10 O c. 12 O d. 15 Oe. None of the given options is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts