Question: Use this information for the next two problems. Rech Company is considering acquiring Ocean Company, a firm that has had big tax losses over the

Use this information for the next two problems.

Rech Company is considering acquiring Ocean Company, a firm that has had big tax losses over the

past few years. As a result of the acquisition, Rech calculates that the total pretax profits of the

merger will not change from their present level for years. The tax loss carryforward of Ocean is

$ and Rech projects that its annual earnings before taxes will be $ per year for each

of the next years. These earnings are assumed to fall within the annual limit legally allowed for

application of the tax loss carryforward resulting from the proposed merger.

The firm is in the tax bracket.

If Rech does not make the acquisition, what will be the company's tax liability and earnings

after taxes in Year Feel free to use the template below if you wish; however, just put your

answer on the answer sheet, not the whole table.

Tax Loss Carry Forward

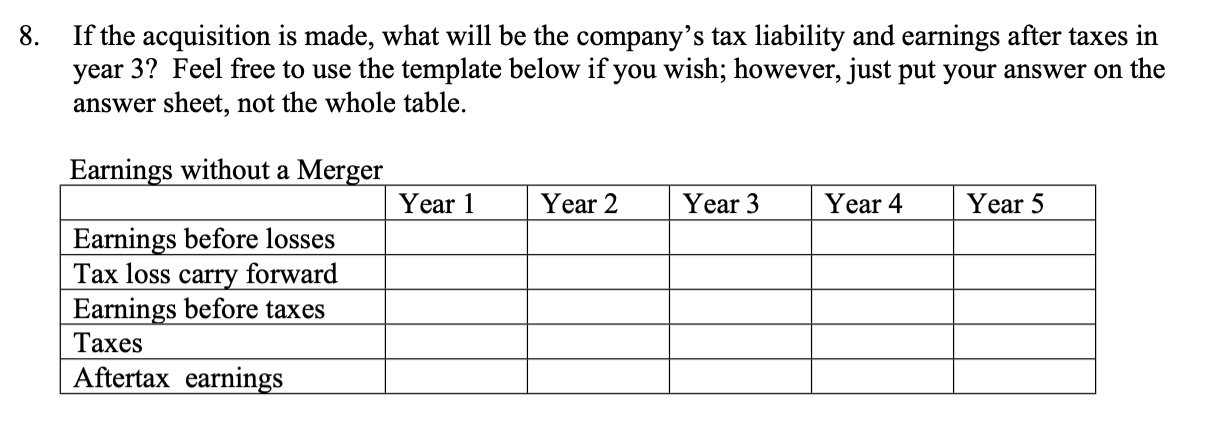

AfterTax Earnings without a MergerIf the acquisition is made, what will be the company's tax liability and earnings after taxes in year Feel free to use the template below if you wish; however, just put your answer on the answer sheet, not the whole table.

Earnings without a Merger

tableYear Year Year Year Year Earnings before losses,,,,,Tax loss carry forward,,,,,Earnings before taxes,,,,,TaxesAftertax earnings,,,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock