Question: Use this information to create a spreadsheet in Journal entry format (not an adjusted journal entry). Done ES ACC 301 Project Unadjusted TB XLSX *

Use this information to create a spreadsheet in Journal entry format (not an adjusted journal entry).

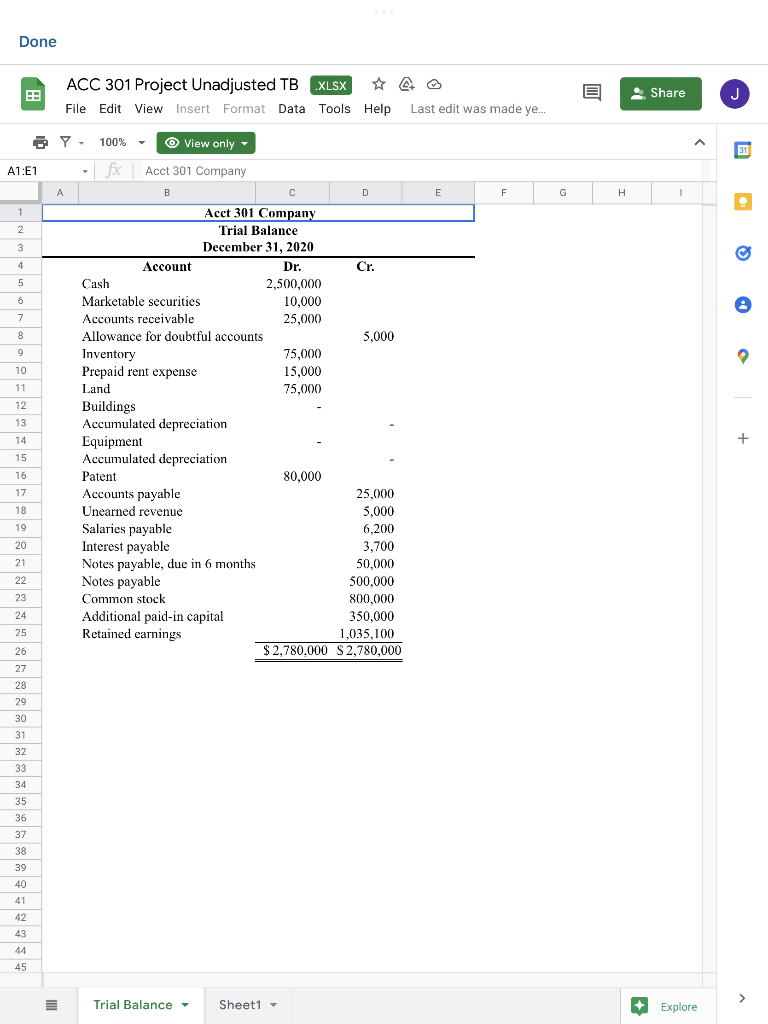

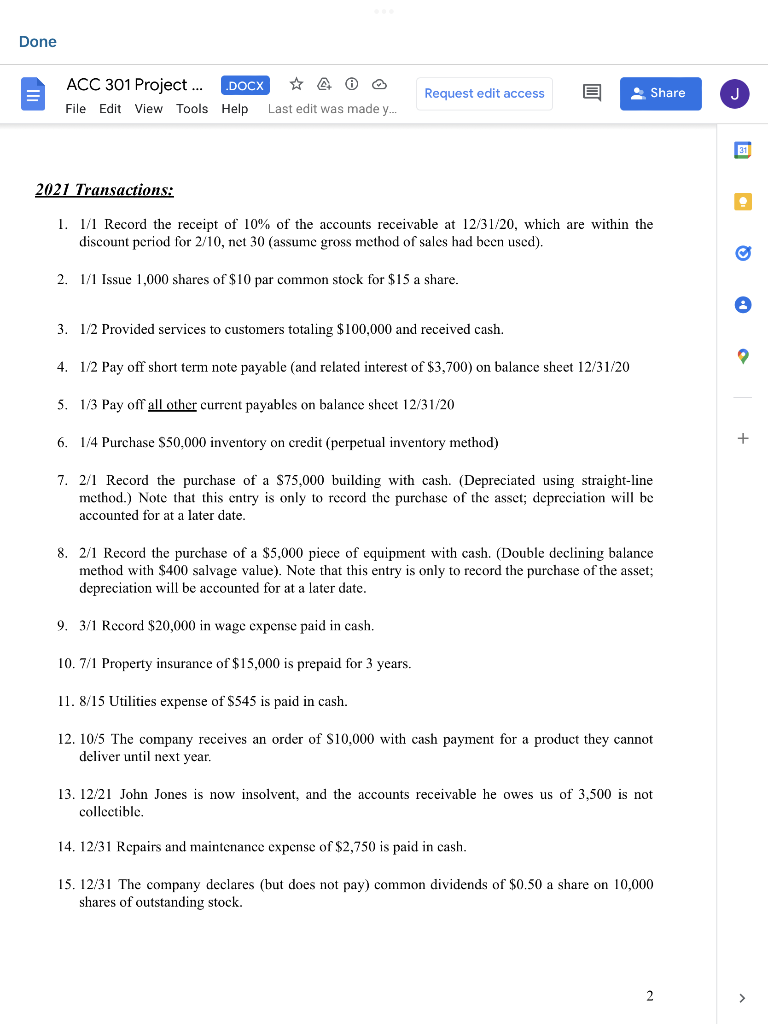

Done ES ACC 301 Project Unadjusted TB XLSX * 4 File Edit View Insert Format Data Tools Help Last edit was made ye. Share J 31 A1:E1 E F G G . H 1 1 2 3 4 5 6 7 8 9 10 11 Y, 100% View only - - fx Acct 301 Company A B D D Acct 301 Company Trial Balance December 31, 2020 Account Dr. Cr. Cash 2,500,000 Marketable securities 10,000 Accounts receivable 25,000 Allowance for doubtful accounts 5,000 Inventory 75,000 Prepaid rent expense 15,000 Land 75,000 Buildings Accumulated depreciation Equipment Accumulated depreciation Patent 80,000 Accounts payable 25,000 Unearned revenue 5,000 Salaries payable 6,200 Interest payable 3,700 Notes payable, due in 6 months 50,000 Notes payable 500,000 Common stock 800,000 Additional paid-in capital 350,000 Retained earnings 1,035,100 $ 2,780,000 S 2,780,000 12 13 14 + 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 45 = Trial Balance - Sheet1 + Explore Done ACC 301 Project ... .DOCX File Edit View Tools Help Last edit was made y... Request edit access E Share 31 2021 Transactions: 1. 1/1 Record the receipt of 10% of the accounts receivable at 12/31/20, which are within the discount period for 2/10, net 30 (assume gross method of sales had been used). 2. 1/1 Issue 1,000 shares of $10 par common stock for $15 a share. 3. 1/2 Provided services to customers totaling $100,000 and received cash. 4. 1/2 Pay off short term note payable and related interest of $3,700) on balance sheet 12/31/20 5. 1/3 Pay off all other current payables on balance sheet 12/31/20 + 6. 1/4 Purchase $50,000 inventory on credit (perpetual inventory method) 7. 2/1 Record the purchase of a $75,000 building with cash. (Depreciated using straight-line method.) Note that this entry is only to record the purchase of the asset; depreciation will be accounted for at a later date. 8. 2/1 Record the purchase of a $5,000 piece of equipment with cash. (Double declining balance method with $400 salvage value). Note that this entry is only to record the purchase of the asset; depreciation will be accounted for at a later date. 9. 3/1 Record $20,000 in wage expense paid in cash. 10.7/1 Property insurance of $15,000 is prepaid for 3 years. 11. 8/15 Utilities expense of $545 is paid in cash. 12. 10/5 The company receives an order of $10,000 with cash payment for a product they cannot deliver until next year. 13. 12/21 John Jones is now insolvent, and the accounts receivable he owes us of 3,500 is not collectible. 14. 12/31 Repairs and maintenance expense of $2,750 is paid in cash. 15. 12/31 The company declares (but does not pay) common dividends of $0.50 a share on 10,000 shares of outstanding stock. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts