Question: use this problem below to find 1- Assume that everything is the same for the project except the marginal tax rate is now 35%. What

use this problem below to find

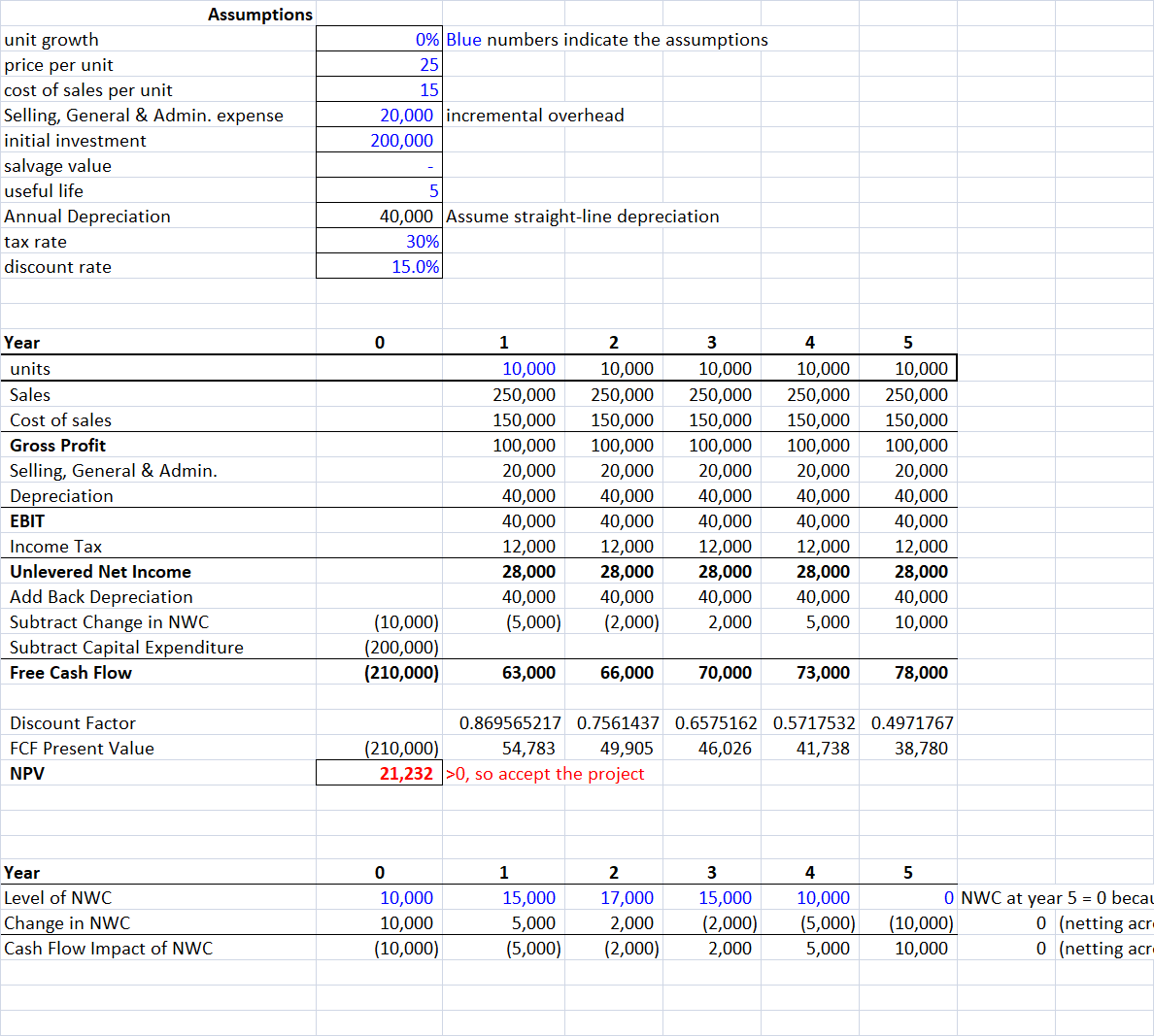

1- Assume that everything is the same for the project except the marginal tax rate is now 35%. What is the new NPV?

2-. Assume that the cost per unit can be decreased to $12 by using cheaper raw materials to produce the shelves. As news of the lower quality shelves spreads, we also expect that units sold will decrease by 7% per year. All other assumptions remain the same. What is the new NPV?

Assumptions unit growth 0% Blue numbers indicate the assumptions price per unit 25 cost of sales per unit 15 Selling, General & Admin. expense 20,000 incremental overhead initial investment 200,000 salvage value useful life 5 Annual Depreciation 40,000 Assume straight-line depreciation tax rate 30% discount rate 15.0% Year 0 1 2 3 4 5 units 10,000 10,000 10,000 10,000 10,000 Sales 250,000 250,000 250,000 250,000 250,000 Cost of sales 150,000 150,000 150,000 150,000 150,000 Gross Profit 100,000 100,000 100,000 100,000 100,000 Selling, General & Admin. 20,000 20,000 20,000 20,000 20,000 Depreciation 40,000 40,000 40,000 40,000 40,000 EBIT 40,000 40,000 40,000 40,000 40,000 Income Tax 12,000 12,000 12,000 12,000 12,000 Unlevered Net Income 28,000 28,000 28,000 28,000 28,000 Add Back Depreciation 40,000 40,000 40,000 40,000 40,000 Subtract Change in NWC (10,000) (5,000) (2,000) 2,000 5,000 10,000 Subtract Capital Expenditure 200,000) Free Cash Flow (210,000) 63,000 66,000 70,000 73,000 78,000 Discount Factor 0.869565217 0.7561437 0.6575162 0.5717532 0.4971767 FCF Present Value 210,000) 54,783 49,905 46,026 41,738 38,780 NPV 21,232 >0, so accept the project Year 0 1 2 3 4 5 Level of NWC 10,000 15,000 17,000 15,000 10,000 0 NWC at year 5 = 0 beca Change in NWC 10,000 5,000 2,000 (2,000) (5,000) (10,000) 0 (netting acr Cash Flow Impact of NWC (10,000) (5,000) (2,000) 2,000 5,000 10,000 0 (netting acr