Question: (Use this problem for question 41.) The Moore Pharmaceutical Company has spent $300 million to date in research expenses for the development of a new

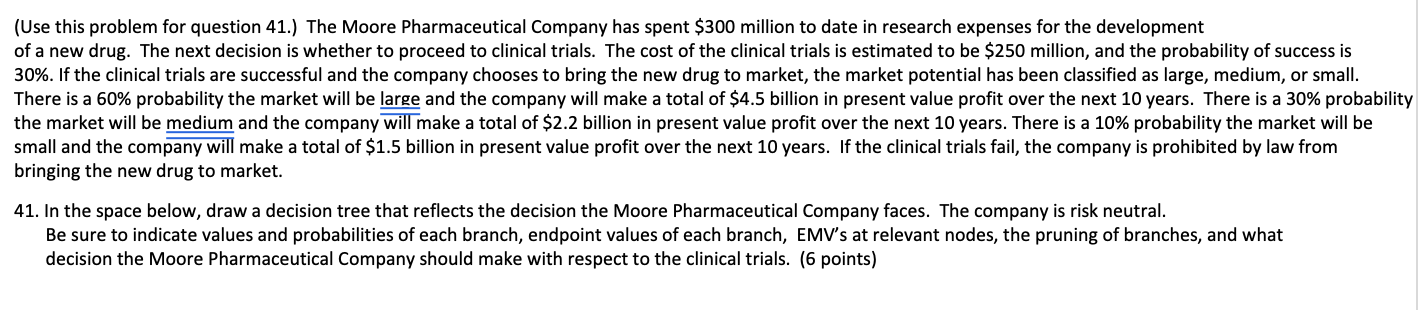

(Use this problem for question 41.) The Moore Pharmaceutical Company has spent $300 million to date in research expenses for the development of a new drug. The next decision is whether to proceed to clinical trials. The cost of the clinical trials is estimated to be $250 million, and the probability of success is 30%. If the clinical trials are successful and the company chooses to bring the new drug to market, the market potential has been classified as large, medium, or small. There is a 60% probability the market will be large and the company will make a total of $4.5 billion in present value profit over the next 10 years. There is a 30% probability the market will be medium and the company will make a total of $2.2 billion in present value profit over the next 10 years. There is a 10% probability the market will be small and the company will make a total of $1.5 billion in present value profit over the next 10 years. If the clinical trials fail, the company is prohibited by law from bringing the new drug to market. 41. In the space below, draw a decision tree that reflects the decision the Moore Pharmaceutical Company faces. The company is risk neutral. Be sure to indicate values and probabilities of each branch, endpoint values of each branch, EMV's at relevant nodes, the pruning of branches, and what decision the Moore Pharmaceutical Company should make with respect to the clinical trials. (6 points) (Use this problem for question 41.) The Moore Pharmaceutical Company has spent $300 million to date in research expenses for the development of a new drug. The next decision is whether to proceed to clinical trials. The cost of the clinical trials is estimated to be $250 million, and the probability of success is 30%. If the clinical trials are successful and the company chooses to bring the new drug to market, the market potential has been classified as large, medium, or small. There is a 60% probability the market will be large and the company will make a total of $4.5 billion in present value profit over the next 10 years. There is a 30% probability the market will be medium and the company will make a total of $2.2 billion in present value profit over the next 10 years. There is a 10% probability the market will be small and the company will make a total of $1.5 billion in present value profit over the next 10 years. If the clinical trials fail, the company is prohibited by law from bringing the new drug to market. 41. In the space below, draw a decision tree that reflects the decision the Moore Pharmaceutical Company faces. The company is risk neutral. Be sure to indicate values and probabilities of each branch, endpoint values of each branch, EMV's at relevant nodes, the pruning of branches, and what decision the Moore Pharmaceutical Company should make with respect to the clinical trials. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts