Question: Use this spreadsheet to answer this Freemore Pty Ltd has developed and produces a lightweight vacuum cleaner. Details relating to this product for November 2

Use this spreadsheet to answer this

Freemore Pty Ltd has developed and produces a lightweight vacuum cleaner. Details relating to this product for November are as follows:

Product: Vacuum Cleaner

Budgeted production for year ending December at normal capacity

Vacuum Cleaners

Annual figures

Budgeted variable manufacturing overhead

$

Budgeted fixed manufacturing overhead

$

Actual sales production figures for the month of November

Units produced

units

Opening stock November

units

Closing stock November

units

Actual costs for the month of November

Direct materials Per unit

$

Direct labour Per unit

$

Variable factory manufacturing overhead

$

Variable selling and administration Per unit

$

Actual fixed costs for the month of November

Factory manufacturing overhead

$

Selling and administration

$

The selling price per unit

$

Opening inventory at November is to be valued at the current unit cost for November

Your manager has asked you to complete the following tasks after telling you the company use a normal costing approach.

Required:

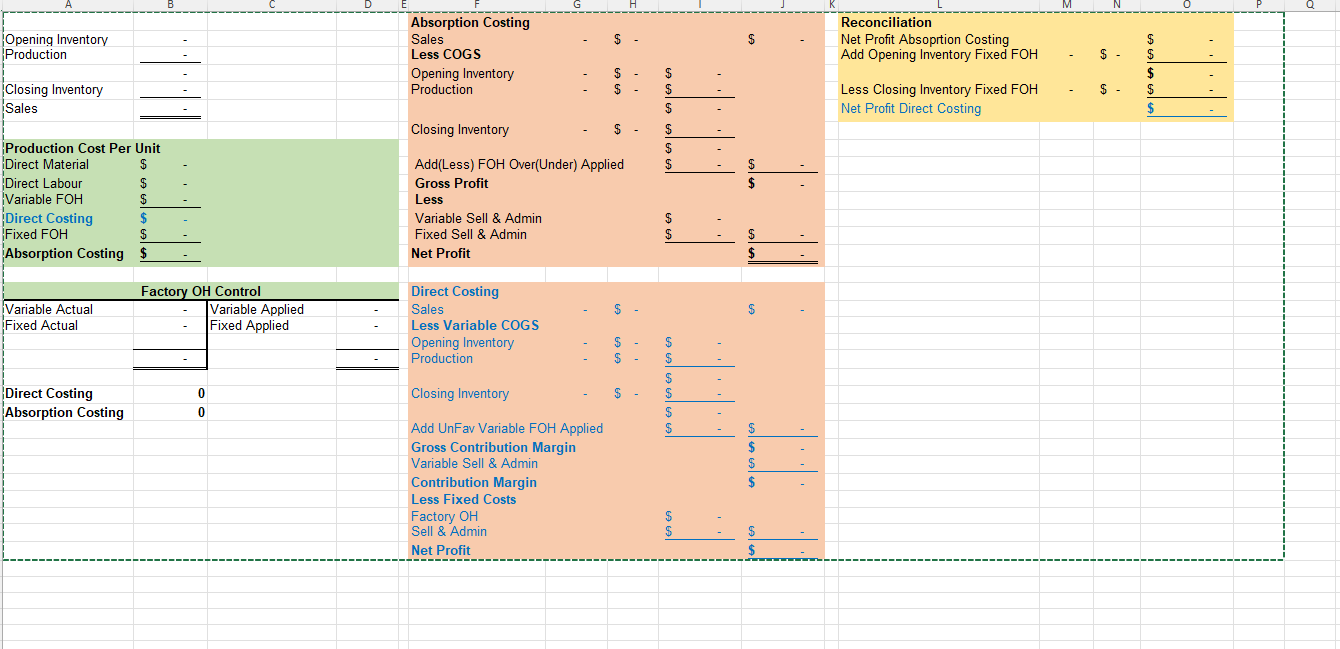

a Calculate the predetermined manufacturing overhead application rates per unit and the unit manufacturing cost to be used in the production of the Absorption and Direct Costing principles.

b Prepare revenue statements using Absorption and Direct Costing principles.

c Prepare reconciliation between the profits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock