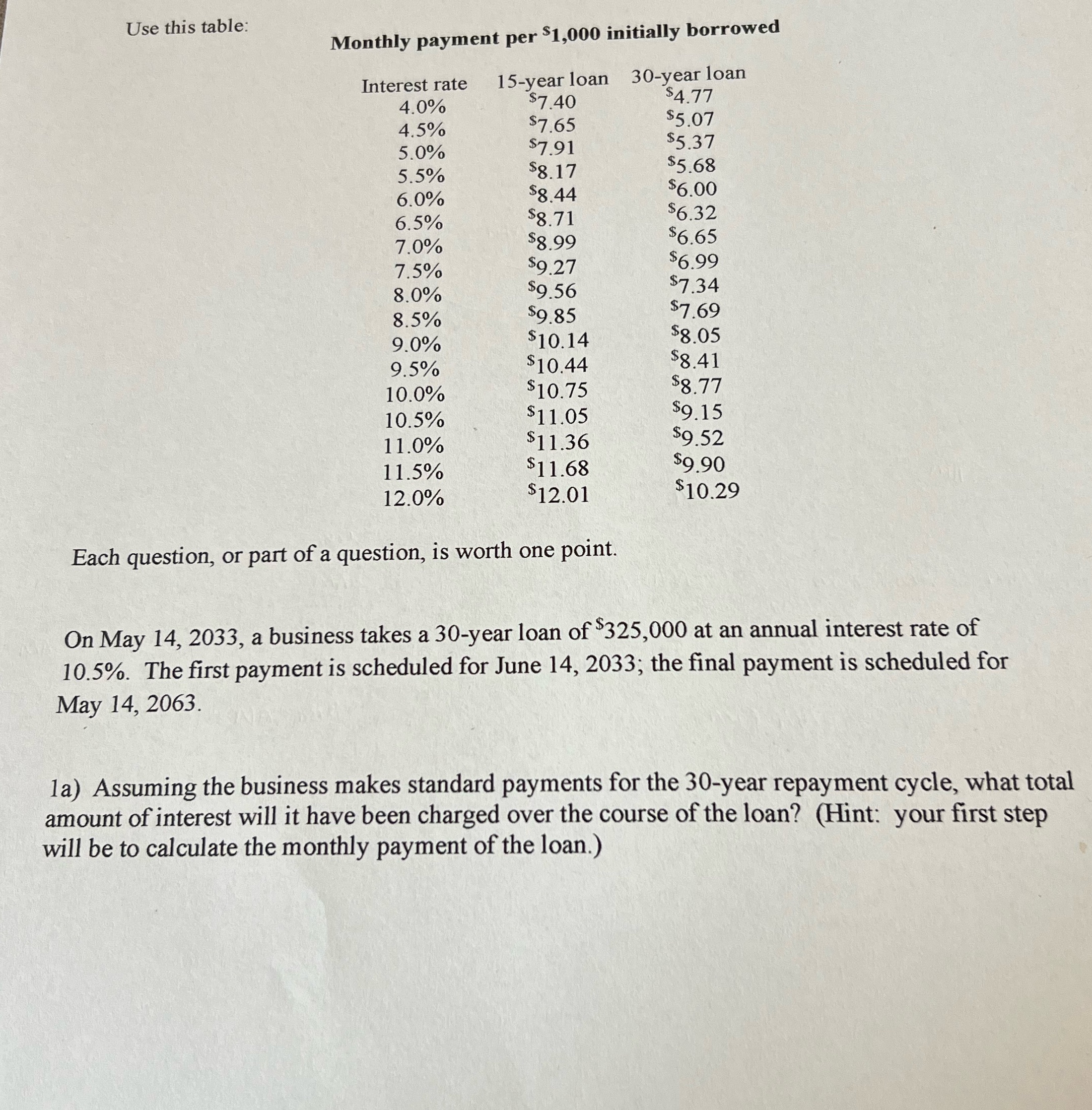

Question: Use this table: Monthly payment per $1,000 initially borrowed Interest rate 15-year loan 30-year loan $7.40 $4.77 4.0% $5.07 4.5% $7.65 $7.91 $5.37 5.0% 5.5%

Use this table: Monthly payment per $1,000 initially borrowed Interest rate 15-year loan 30-year loan $7.40 $4.77 4.0% $5.07 4.5% $7.65 $7.91 $5.37 5.0% 5.5% $8.17 $5.68 $6.00 6.0% $8.44 6.5% $8.71 $6.32 7.0% $8.99 $6.65 $9.27 $6.99 7.5% 8.0% $9 56 $7.34 8.5% $9.85 $7.69 $10.14 $8.05 9.0% 9.5% $10.44 $8.41 10.0% $10.75 $8.77 10.5% $11.05 $9.15 11.0% $11.36 $9.52 11.5% $1 1.68 $9 90 12.0% $12.01 $10.29 Each question, or part of a question, is worth one point. On May 14, 2033, a business takes a 30-year loan of $325,000 at an annual interest rate of 10.5%. The first payment is scheduled for June 14, 2033; the final payment is scheduled for May 14, 2063. la) Assuming the business makes standard payments for the 30-year repayment cycle, what total amount of interest will it have been charged over the course of the loan? (Hint: your first step will be to calculate the monthly payment of the loan.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts