Question: Use this template that I attached to answer the question prepare templates (Balance Sheet) that would show the accounting for the sale of the bonds

Use this template that I attached to answer the question "prepare templates (Balance Sheet) that would show the accounting for the sale of the bonds and the first two interest payments."

This is the example from a textbook, please use it as a reference. THE CHART BELOW IS AN EXAMPLE NOT THE QUESTION.

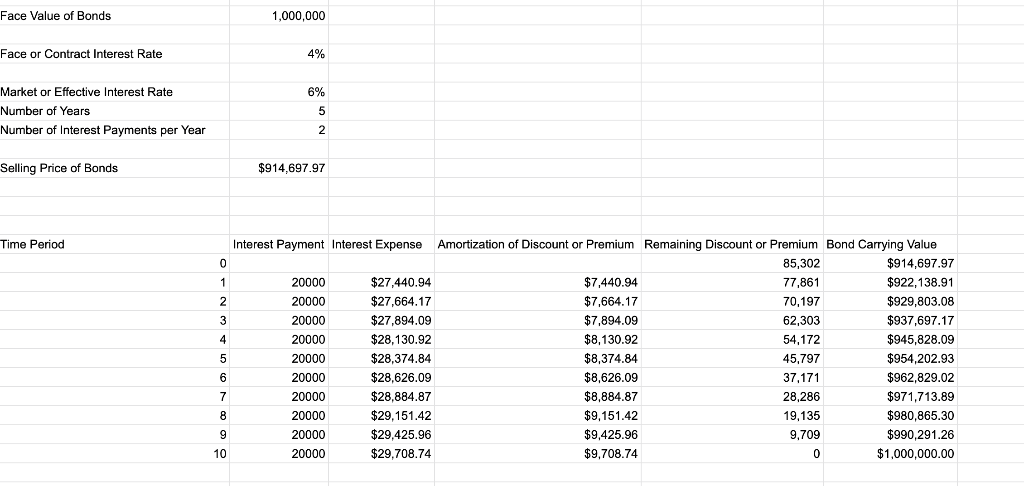

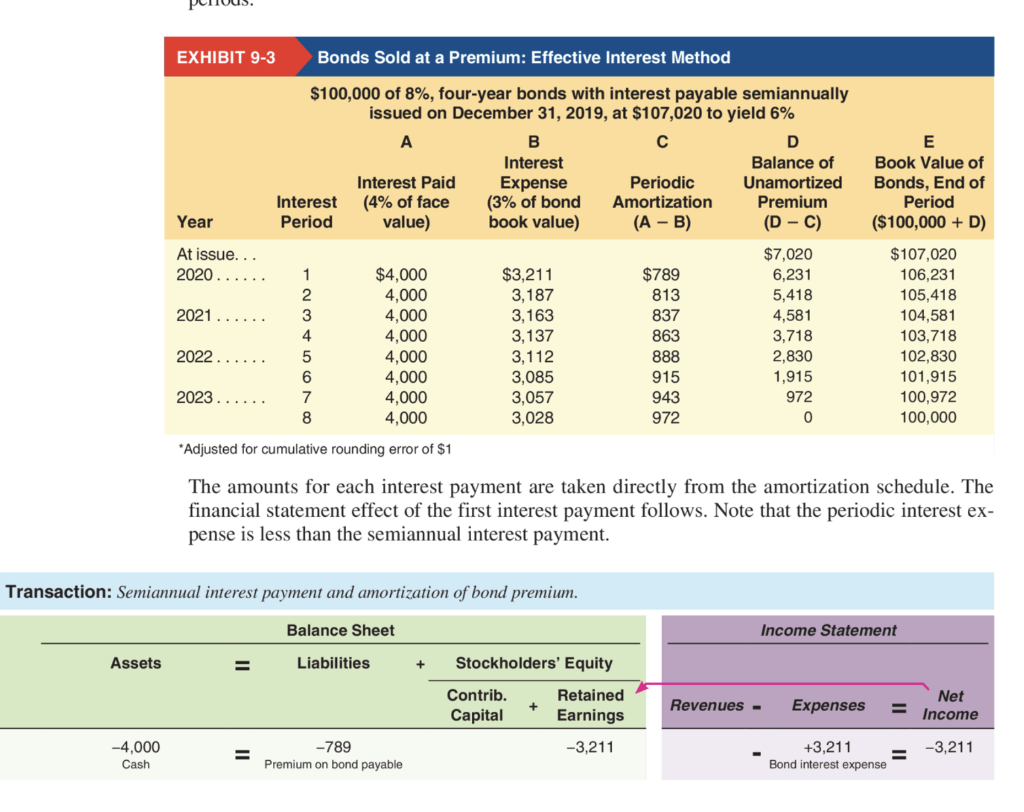

Face Value of Bonds 1,000,000 Face or Contract Interest Rate 4% 6% Market or Effective Interest Rate Number of Years Number of Interest Payments per Year 5 2 Selling Price of Bonds $914,697.97 Time Period 0 1 2 3 4 Interest Payment Interest Expense Amortization of Discount or Premium Remaining Discount or Premium Bond Carrying Value 85,302 $914,697.97 20000 $27,440.94 $7,440.94 77,861 $922,138.91 20000 $27,664.17 $7,664.17 70,197 $929,803.08 20000 $27,894.09 $7,894.09 62,303 $937,697.17 20000 $28,130.92 $8,130.92 54,172 $945,828.09 20000 $28,374.84 $8,374.84 45,797 $954,202.93 20000 $28,626.09 $8,626.09 37,171 $962,829.02 20000 $28,884.87 $8,884.87 28,286 $971,713.89 20000 $29,151.42 $9,151.42 19,135 $980,865.30 20000 $29,425.96 $9,425.96 9,709 $990,291.26 20000 $29,708.74 $9,708.74 0 $1,000,000.00 5 6 7 8 9 10 EXHIBIT 9-3 Bonds Sold at a Premium: Effective Interest Method E Book Value of Bonds, End of Period ($100,000 + D) Year At issue... 2020 $100,000 of 8%, four-year bonds with interest payable semiannually issued on December 31, 2019, at $107,020 to yield 6% A B D Interest Balance of Interest Paid Expense Periodic Unamortized Interest (4% of face (3% of bond Amortization Premium Period value) book value) (A - B) (D - C) $7,020 1 $4,000 $3,211 $789 6,231 2 4,000 3,187 813 5,418 3 4,000 3,163 837 4,581 4 4,000 3,137 863 5 4,000 3,112 888 2,830 6 4,000 3,085 1,915 7 4,000 3,057 943 972 8 4,000 3,028 972 0 2021. 3,718 $107,020 106,231 105,418 104,581 103,718 102,830 101,915 100,972 100,000 2022. 915 2023..... *Adjusted for cumulative rounding error of $1 The amounts for each interest payment are taken directly from the amortization schedule. The financial statement effect of the first interest payment follows. Note that the periodic interest ex- pense is less than the semiannual interest payment. Transaction: Semiannual interest payment and amortization of bond premium. Balance Sheet Income Statement Assets = Liabilities + Stockholders' Equity Contrib. Capital + Retained Earnings Revenues - Expenses Net Income -3,211 -4,000 Cash -3,211 = -789 Premium on bond payable +3,211 Bond interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts