Question: use vertical analysis (common sized financial statements), horizontal analysis (both the change in dollar amounts and percentage), and finally calculate the ratios/measurements listed below for

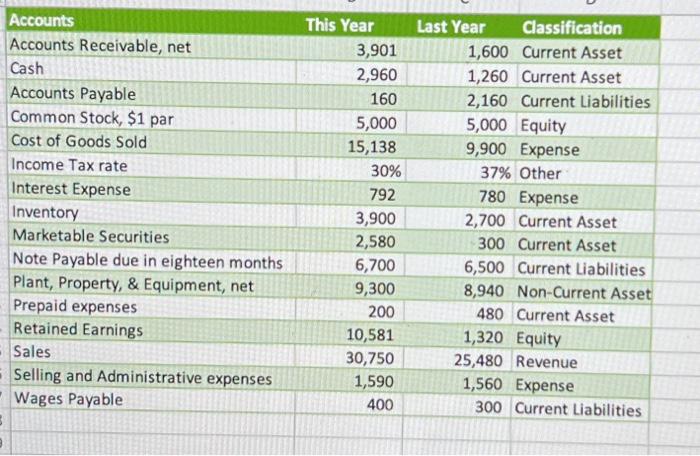

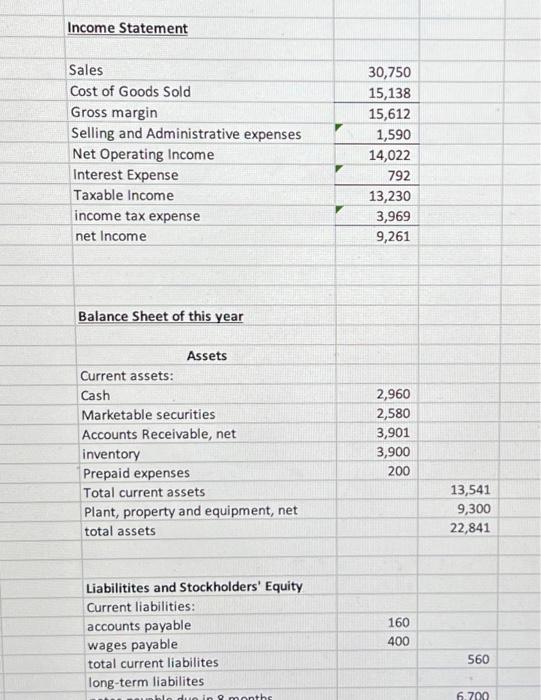

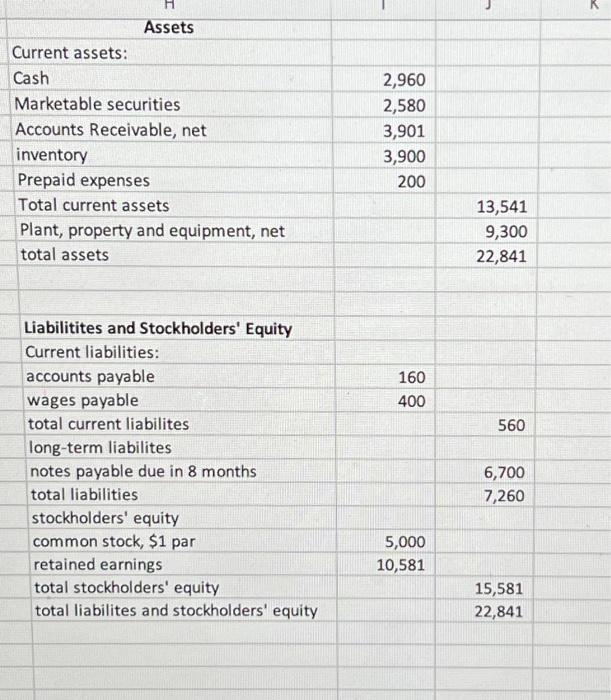

use vertical analysis (common sized financial statements), horizontal analysis (both the change in dollar amounts and percentage), and finally calculate the ratios/measurements listed below for both years. The ratios should be labeled and numbered one through ten. Make sure that dollar signs are used where appropriate, and that other markings such as percent signs are also applied when needed. Calculate to the second decimal place the following: Working Capital, Current Ratio, Acid-test Ratio, Accounts Receivable Turnover, Average Collection Period, Inventory Turnover, Debt-to-Equity Ratio, Gross Margin Percentage, Net Profit Margin Percentage, and Return on Assets. See the back side of this sheet for more detail on the expektations and requirements. \begin{tabular}{|l|r|r|l|} \hline Accounts & This Year & Last Year & Classification \\ \hline Accounts Receivable, net & 3,901 & 1,600 & Current Asset \\ \hline Cash & 2,960 & 1,260 & Current Asset \\ \hline Accounts Payable & 160 & 2,160 & Current Liabilities \\ \hline Common Stock, \$1 par & 5,000 & 5,000 & Equity \\ \hline Cost of Goods Sold & 15,138 & 9,900 & Expense \\ \hline Income Tax rate & 30% & 37% & Other \\ \hline Interest Expense & 792 & 780 & Expense \\ \hline Inventory & 3,900 & 2,700 & Current Asset \\ \hline Marketable Securities & 2,580 & 300 & Current Asset \\ \hline Note Payable due in eighteen months & 6,700 & 6,500 & Current Liabilities \\ \hline Plant, Property, \& Equipment, net & 9,300 & 8,940 & Non-Current Asset \\ \hline Prepaid expenses & 200 & 480 & Current Asset \\ \hline Retained Earnings & 10,581 & 1,320 & Equity \\ \hline Sales & 30,750 & 25,480 & Revenue \\ \hline Selling and Administrative expenses & 1,590 & 1,560 & Expense \\ \hline Wages Payable & 400 & 300 & Current Liabilities \\ \hline & & & \\ \hline \end{tabular} Assets Current assets: Cash Marketable securities Accounts Receivable, net inventory Prepaid expenses Total current assets Plant, property and equipment, net total assets 2,960 2,580 3,901 3,900 200 Liabilitites and Stockholders' Equity Current liabilities: accounts payable wages payable total current liabilites 560 long-term liabilites notes payable due in 8 months total liabilities 6,700 stockholders' equity 7,260 common stock, \$1 par retained earnings 5,000 total stockholders' equity 10,581 total liabilites and stockholders' equity 15,581 22,841

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts