Question: Use your own format to answer the question. No need to use the prescribed book format. The image may appear to be small. But once

Use your own format to answer the question. No need to use the prescribed book format. The image may appear to be small. But once downloaded, you can zoom it and everything will be visible.

Use your own format to answer the question. No need to use the prescribed book format. The image may appear to be small. But once downloaded, you can zoom it and everything will be visible.

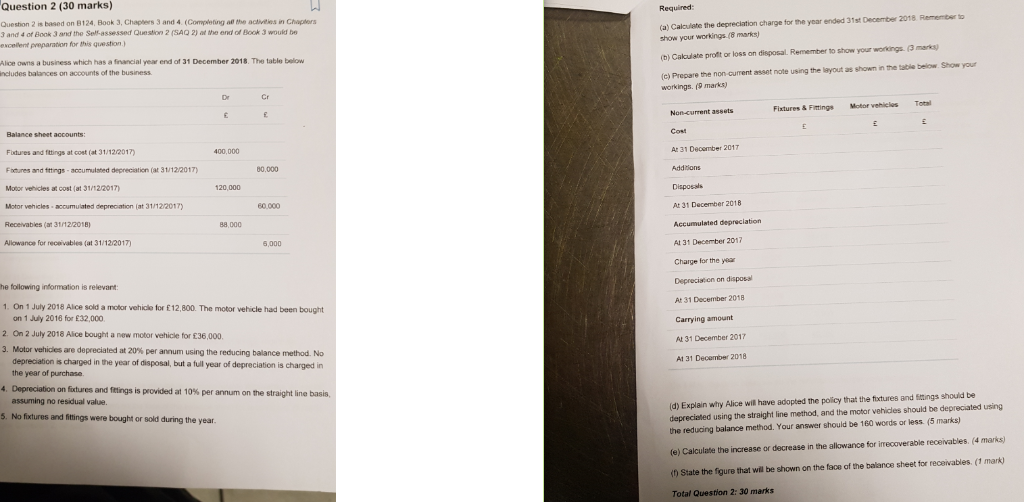

Question 2 (30 marks) Required: Question 2 is based on 8124, Book 3, Chapters 3 and 4. (Completing al the activities in Chaptors 3 and 4 of Book 3 and the Self-assessed Question 2 (SAQ 2) ad the end of Book 3 would be excellent preparation for this question (a) Calculate the depreciation charge for the year ended 31st December 2018 Remember to show your workings (8 marks) b) Calculate proft or loss on disposal. Remember to show your workdings (3 marks) (c) Prepare the non-current asset note using the layout as shown in the table below Show your Alice owns a business which has a financial year end of 31 December 2018. The table below ncludes balances on accounts of the business workings. (9 marks) Dr Cr Fixtures & Fittings Motor vehicles Total Fidures and fittings at cost (at 31/122017) Fatures and fttings-accumulated depreciation (at 31/12/2017) Motor vehicles at cost (at 31/122017) Motor vehicles accumulated depreciation (at 31/12/2017) Receivables (at 31/12/2018) Allowance for receivables (at 31/12/2017) Cost At 31 Deoomber 2017 Addions Disposals At 31 December 2018 400,000 80,000 20,000 88,000 At 31 December 2017 Charge for the year Deprecistcn on disposal At 31 December 2018 Carrying amount At 31 December 2017 A1 31 December 2018 ,000 he following information is relevant On 1 July 2018 Alce sold a motor vehicle for 12,800. The motor vehicle had been bought on 1 July 2018 for 32,000 2. On 2 July 2018 Alice bought a new motor vehicle for 36,000. 3. Motor vehicles are depreciated at 20% per annum using the reducing balance method. No depreciation is charged in the year of disposal, but a full year of depreciation is charged in the year of purchase 4, Depreciation on fixtures and fittings is provided at 10% per annum on the straight line basis, (d) Explain why Alice will have adopted the policy that the fatures and itings should be depreciated using the straight line method, and the motor vehicles should be depreciated using the reducing balance method. Your answer should be 160 words or less. (5 marks) assuming no residual value. 5. No fixtures and fittings were bought or sold during the year (e) Calculate the increase or decrease in the allowance for irrecoverable receivables. (4 marks) t) State the figure that will be shown on the face of the balance sheet for receivables. (1 mark) Total Question 2: 30 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts