Question: USE YOUR SMARTPHONE FOR SCAN 526 Chapter 14 Long-Term Liabilities Exercise 14-3 Recording bond issuance and interest P1 On January 1, Boston Enterprises issues bonds

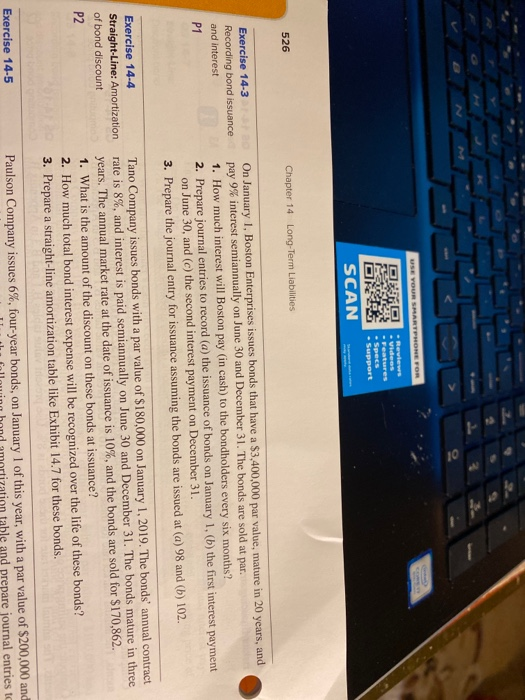

USE YOUR SMARTPHONE FOR SCAN 526 Chapter 14 Long-Term Liabilities Exercise 14-3 Recording bond issuance and interest P1 On January 1, Boston Enterprises issues bonds that have a $3,400,000 par value, mature in 20 years, and pay 9% interest semiannually on June 30 and December 31. The bonds are sold at par. 1. How much interest will Boston pay (in cash) to the bondholders every six months? 2. Prepare journal entries to record (a) the issuance of bonds on January 1, (b) the first interest payment on June 30, and (c) the second interest payment on December 31. 3. Prepare the journal entry for issuance assuming the bonds are issued at (a) 98 and (b) 102. Exercise 14-4 Straight-Line: Amortization of bond discount P2 Tano Company issues bonds with a par value of $180,000 on January 1, 2019. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $170,862. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table like Exhibit 14.7 for these bonds. Exercise 14-5 Paulson Company issues 6%, four-year bonds, on January 1 of this year, with a par value of $200,000 and following hond amortization table and prepare journal entries to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts