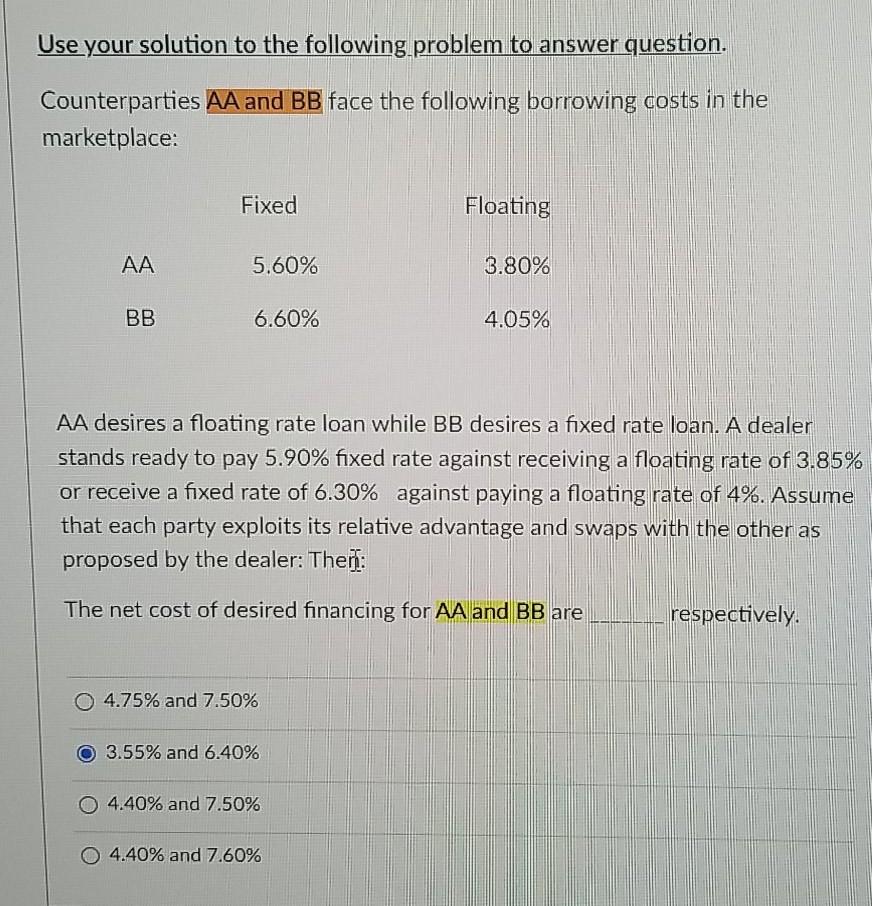

Question: Use your solution to the following problem to answer question. Counterparties AA and BB face the following borrowing costs in the marketplace: Fixed Floating AA

Use your solution to the following problem to answer question. Counterparties AA and BB face the following borrowing costs in the marketplace: Fixed Floating AA 5.60% 3.80% BB 6.60% 4.05% AA desires a floating rate loan while BB desires a fixed rate loan. A dealer stands ready to pay 5.90% fixed rate against receiving a floating rate of 3.85% or receive a fixed rate of 6.30% against paying a floating rate of 4%. Assume that each party exploits its relative advantage and swaps with the other as proposed by the dealer: Then: The net cost of desired financing for AA and BB are respectively 0 4.75% and 7.50% 3.55% and 6.40% 0 4.40% and 7.50% 4.40% and 7.60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts