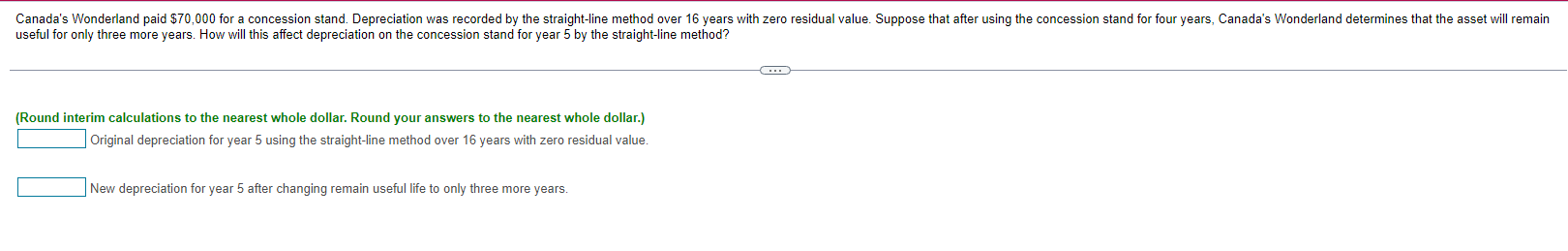

Question: useful for only three more years. How will this affect depreciation on the concession stand for year 5 by the straight-line method? (Round interim calculations

useful for only three more years. How will this affect depreciation on the concession stand for year 5 by the straight-line method? (Round interim calculations to the nearest whole dollar. Round your answers to the nearest whole dollar.) Original depreciation for year 5 using the straight-line method over 16 years with zero residual value. New depreciation for year 5 after changing remain useful life to only three more years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts