Question: user Java 3. The personal income tax is calculated based on filing status and taxable income. There are four filing statuses: single filers, married filing

user Java

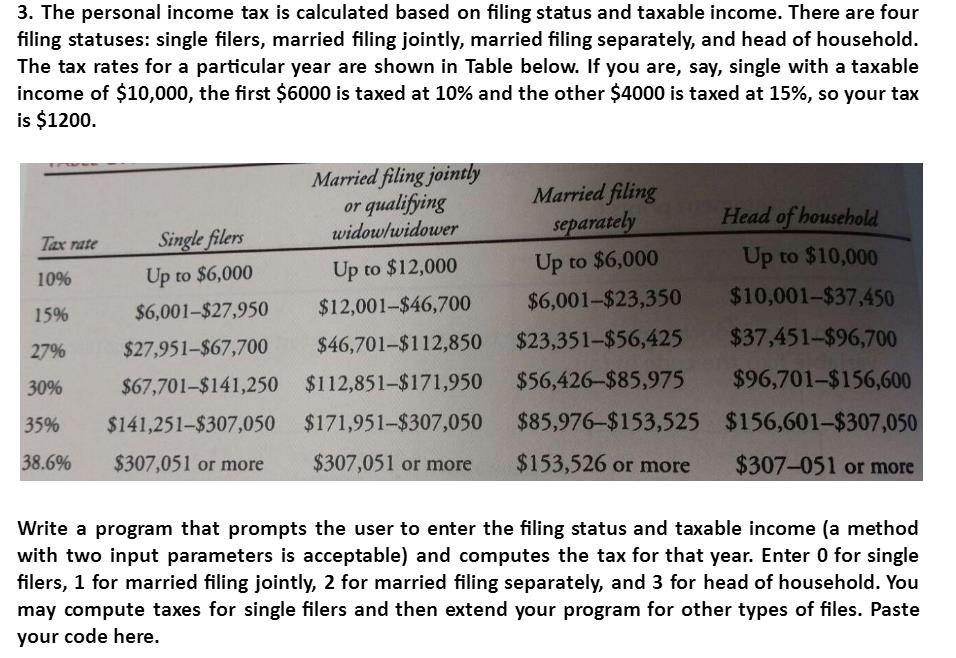

3. The personal income tax is calculated based on filing status and taxable income. There are four filing statuses: single filers, married filing jointly, married filing separately, and head of household. The tax rates for a particular year are shown in Table below. If you are, say, single with a taxable income of $10,000, the first $6000 is taxed at 10% and the other $4000 is taxed at 15%, so your tax is $1200. Married filing jointly or qualifying widowlwidower Married filing separately Head of household Up to $10,000 Tax rateSingle filers 10% 15% 27% 30% Up to $12,000 Up to $6,000 Up to $6,000 $6,001-$27,950 $12,001-$46,700 $6,001-$23,350 $10,001-$37,450 $27,951-$67,700 $46,701-$112,850 $23,351-$56,425 $37,451-$96,700 $67,701-$141,250 $112,851-$171,950 $56,426-$85,975 $96,701-$156,600 $156,601-$307,050 $307-051 or more 35% $141,251-$307,050 $171,95 l-S307,050 $85,976-$153,525 38.6% $307,051 or more $307,051 or more $153,526 or more Write a program that prompts the user to enter the filing status and taxable income (a method with two input parameters is acceptable) and computes the tax for that year. Enter 0 for single filers, 1 for married filing jointly, 2 for married filing separately, and 3 for head of household. You may compute taxes for single filers and then extend your program for other types of files. Paste your code here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts