Question: Using 2018 Tax Table : married filling jointly 3,186 / Single $17,864 Using 2018 Tax Rate Schedule : Married filing Jointly If taxable income is

Using 2018 Tax Table : married filling jointly 3,186 / Single $17,864

Using 2018 Tax Rate Schedule : Married filing Jointly If taxable income is over $19,050 but not over $77,400The Tax is $1,905.00 plus 12% of the excess over $19,050

If single if taxable income is over $82,500 but not over $157,500 The tax is $14,089.50 plus 24%of the excess over $82,500

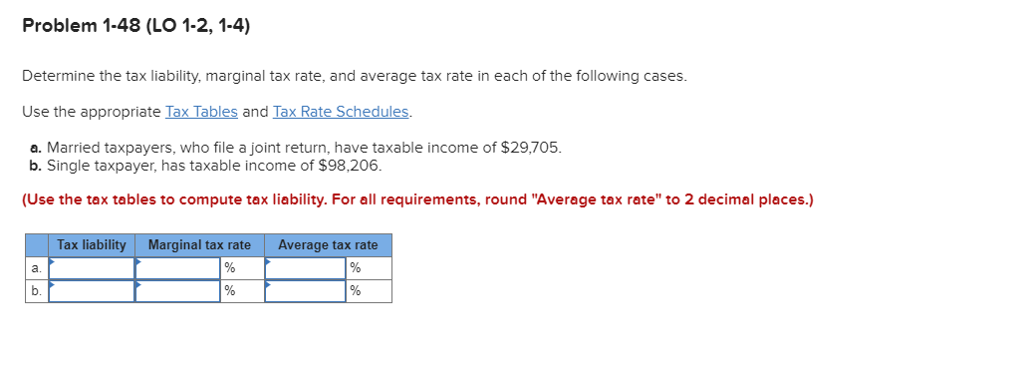

Problem 1-48 (LO 1-2, 1-4) Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Married taxpayers, who file a joint return, have taxable income of $29,705. b. Single taxpayer, has taxable income of $98,206. (Use the tax tables to compute tax liability. For all requirements, round "Average tax rate" to 2 decimal places.) Tax liability Marginal tax rate Average tax rate b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts