Question: Using 2020 depreciation tables Problem 8-4 (Algorithmic) Modified Accelerated Cost Recovery System (MACRS) (LO 8.2) On December 8, 2020, Holly purchased a residential apartment building.

Using 2020 depreciation tables

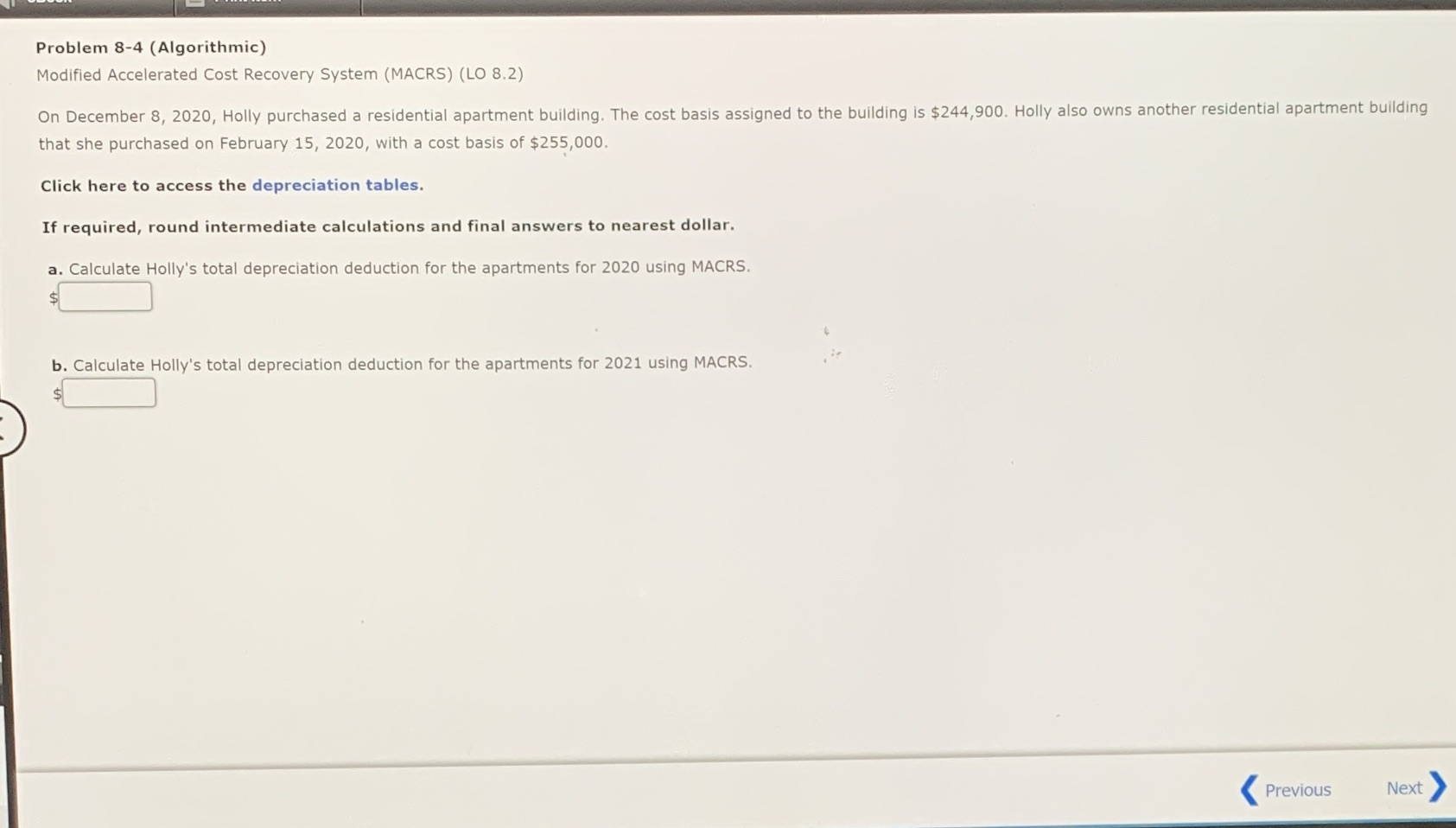

Problem 8-4 (Algorithmic) Modified Accelerated Cost Recovery System (MACRS) (LO 8.2) On December 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $244,900. Holly also owns another residential apartment building that she purchased on February 15, 2020, with a cost basis of $255,000. Click here to access the depreciation tables. If required, round intermediate calculations and final answers to nearest dollar. a. Calculate Holly's total depreciation deduction for the apartments for 2020 using MACRS. b. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS. Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts