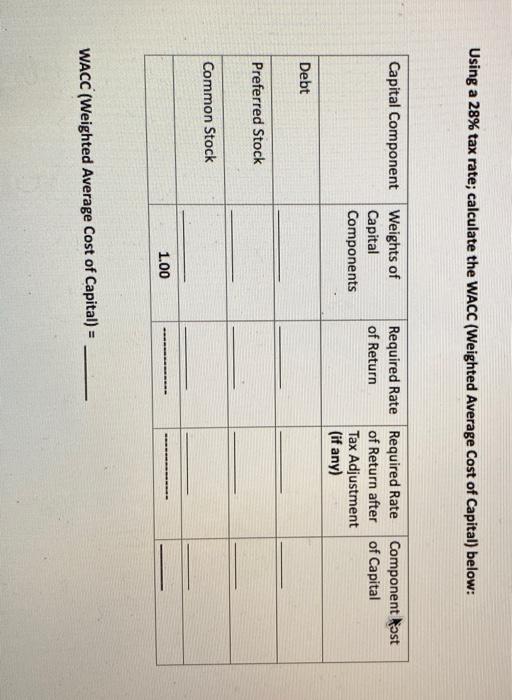

Question: Using a 28% tax rate; calculate the WACC (Weighted Average Cost of Capital) below: Capital Component Weights of Capital Components Required Rate Required Rate Component

Using a 28% tax rate; calculate the WACC (Weighted Average Cost of Capital) below: Capital Component Weights of Capital Components Required Rate Required Rate Component fost of Return of Return after of Capital Tax Adjustment (if any) Debt Preferred Stock Common Stock 1.00 WACC (Weighted Average Cost of Capital) =

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock