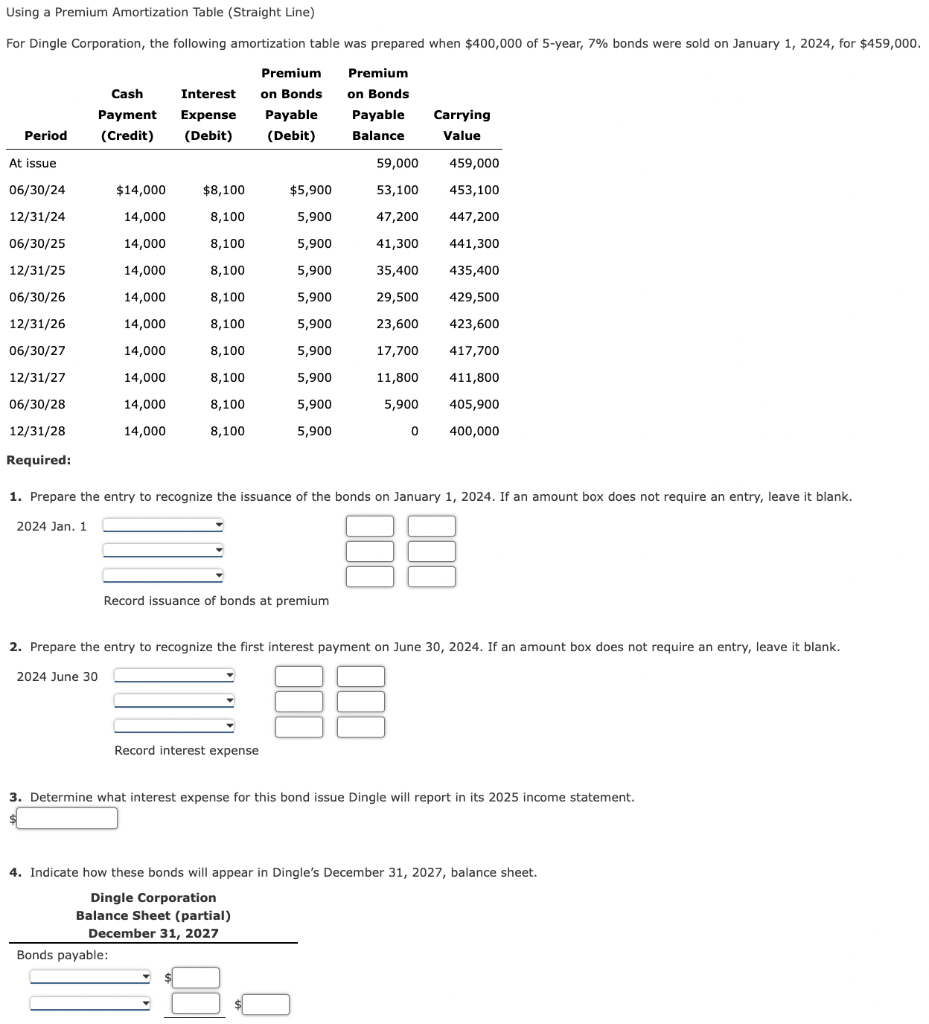

Question: Using a Premium Amortization Table (Straight Line) For Dingle Corporation, the following amortization table was prepared when $400,000 of 5 -year, 7% bonds were sold

Using a Premium Amortization Table (Straight Line) For Dingle Corporation, the following amortization table was prepared when $400,000 of 5 -year, 7% bonds were sold on January 1,2024 , for $459,000 Required: 1. Prepare the entry to recognize the issuance of the bonds on January 1,2024 . If an amount box does not require an entry, leave it blank. 2 kecora issuance or Donas at premium 2. Prepare the entry to recognize the first interest payment on June 30,2024 . If an amount box does not require an entry, leave it blank. 20 3. Determine what interest expense for this bond issue Dingle will report in its 2025 income statement. 4. Indicate how these bonds will appear in Dingle's December 31,2027 , balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts