Question: Using a spreadsheet and based on the information provided in the next section, complete the following requirements: Determine the predetermined overhead rate. Determine the total

Using a spreadsheet and based on the information provided in the next section, complete the following

requirements:

Determine the predetermined overhead rate.

Determine the total number of mini sport balls to account for.

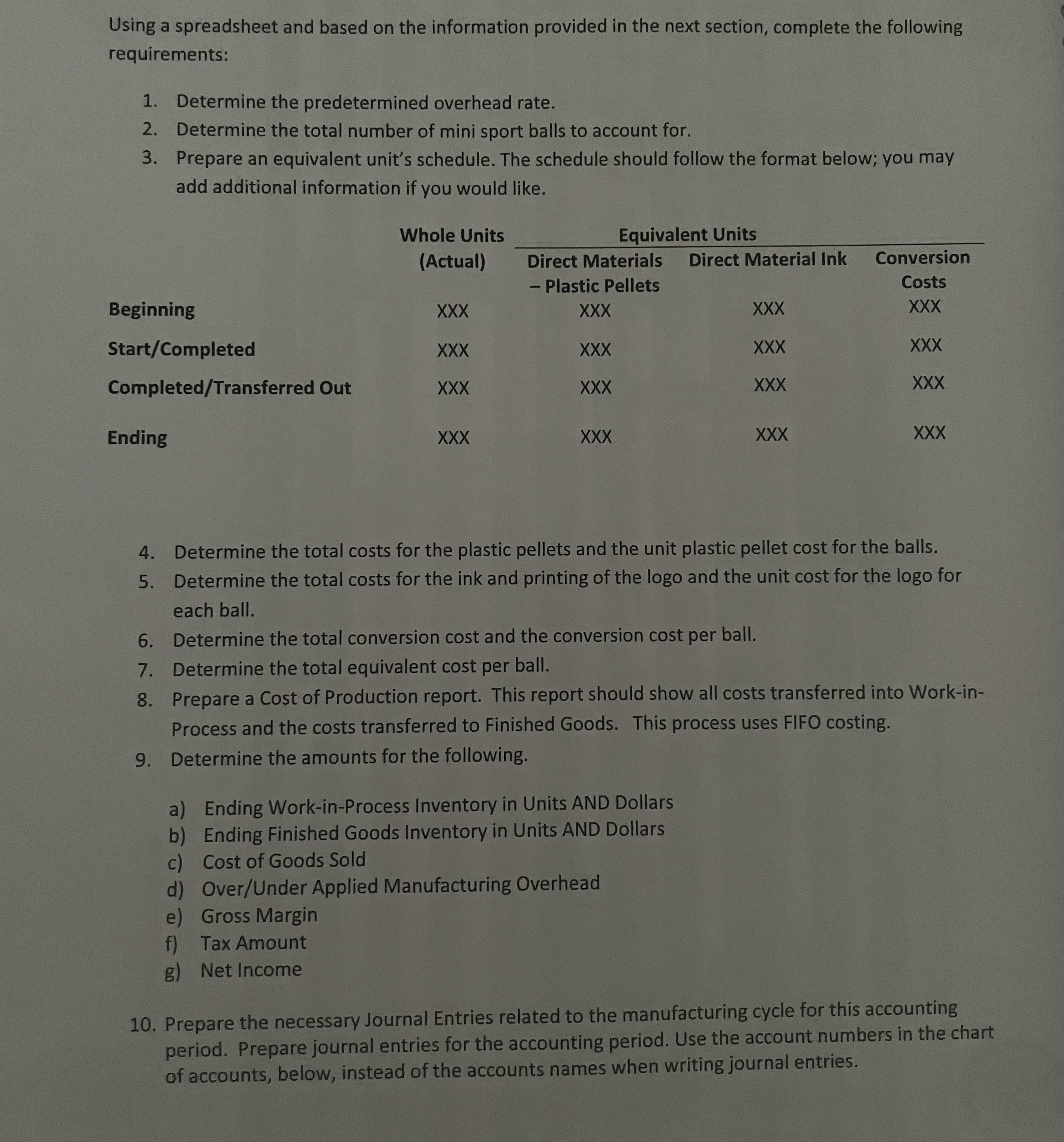

Prepare an equivalent unit's schedule. The schedule should follow the format below; you may

add additional information if you would like.

Determine the total costs for the plastic pellets and the unit plastic pellet cost for the balls.

Determine the total costs for the ink and printing of the logo and the unit cost for the logo for

each ball.

Determine the total conversion cost and the conversion cost per ball.

Determine the total equivalent cost per ball.

Prepare a Cost of Production report. This report should show all costs transferred into Workin

Process and the costs transferred to Finished Goods. This process uses FIFO costing.

Determine the amounts for the following.

a Ending WorkinProcess Inventory in Units AND Dollars

b Ending Finished Goods Inventory in Units AND Dollars

c Cost of Goods Sold

d OverUnder Applied Manufacturing Overhead

e Gross Margin

f TaxAmount

g Net Income

Prepare the necessary Journal Entries related to the manufacturing cycle for this accounting

period. Prepare journal entries for the accounting period. Use the account numbers in the chart

of accounts, below, instead of the accounts names when writing journal entries.

CHART OF ACCOUNTS

Revenues

Sales

Expenses

COGS

Journal Entries

a In the first journal entry record the purchase of plastic pellets and the ink materials using cash

and combine it in one journal entry.

b Record the materials, plastic pellets and ink, transferred to WIP. Again, use one journal entry to

record the transfer of the plastic pellets and ink.

c Record the direct labor into WIP using Wages Payable.

d Record the applied FOH.

e Record the actual FOH using cash.

f Record the over or under applied FOH

g Record the sale of the goods on account along with the cost of the inventory that was sold.

Combine both into one journal entry.

Manufacturing Process Information

Slam, Dunk, Score, Inc. started a small manufacturing plant that manufactures mini sport balls with logos

printed on them. The manufacturing process starts by pouring the plastic pellets into molds, melting and

forming the balls and then printing the logo onto the balls after they are formed. The printing of the

logo will be the last step in the production process. The resulting balls are then sent to quality control

and if the inspection is approved, they are transferred to finished goods. This process is completely

automated.

Direct material, Plastic Pellets, is added at the beginning of the process.

Direct material ink, for the logo is added at the end of the process.

Conversion costs are added equally throughout the process. Conversion is complete for the

beginning inventory work in process and complete for the ending inventory work in process.

At the beginning of the accounting period, Slam, Dunk, Score, Inc. started units. The

predetermined factory overhead rate is based on an estimated FOH cost of $ Overhead is applied

to production based on direct labor hours. This information is to be used to determine the application

rate for overhead.

Estimated and actual direct labor costs totaled $ which is calculated at $ per hour.

Actual factory overhead costs totaled $

Beginning WorkinProcess costs totaled $ since this is the first month of production.

The following information is available concerning direct materials.

Direct MaterialsPlastic

Beginning inventory

Purchase of Plastic Pellets

Ending Inventory

One pound of plastic makes balls

plastic pellets @ $ per pound

pounds @ $ per pound

pounds @ $ per pound

Direct MaterialInk

Beginning inventory

Purchases of Ink

Ending inventory

One cartridge will print balls

ink cartridges @ $ per cartridge

cartridges @ $ per cartridge

cartridges @ $ per cartridge

The WorkinProcess account has the following information

Beginning WorkinProcess contains equivalent units

Ending WorkinProcess contains equivalent units

The Finished Goods account has the following Information

Beginning Finished Goods contains balls

Ending Finished Goods contains balls

The selling price is $ per ball and balls were sold

Selling and Administrative Costs totaled $; tax rate is The Finished Goods account has the following Information

Beginning Finished Goods contains balls

Ending Finished Goods contains balls

The selling price is $ per ball and balls were sold

Selling and Administrative Costs totaled $; tax rate is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock