Question: using absorption and variable costing An Example Howell, Jnc., produces a single product with a price of $40. They sold 28,000 units in v a

using absorption and variable costing

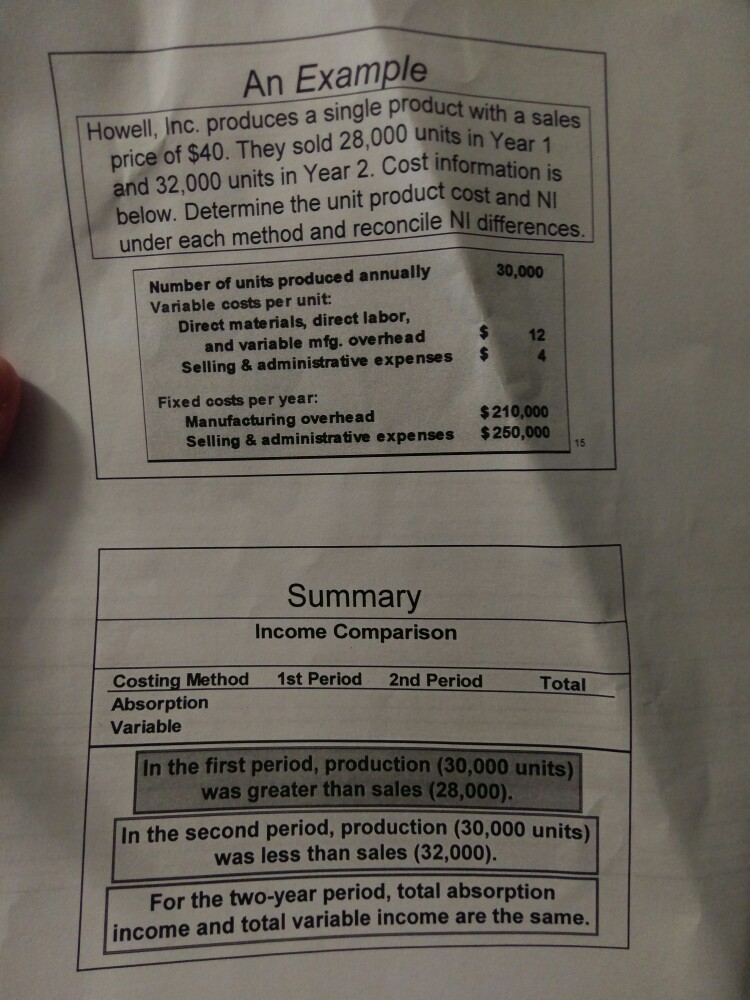

An Example Howell, Jnc., produces a single product with a price of $40. They sold 28,000 units in v a Sales and 32,000 units in Year 2. Cost informata below. Determine the unit product cost and under each method and reconcile NI differe ear 1 n is NI Number of units produced annually Variable costs per unit 30,000 Direct materials, direct labor and variable mfg. overhead Selling & administrative expenses 4 12 Fixed costs per year: $210,000 Manufacturing overhead Selling & administrative expenses 250,000 15 Summary Income Comparison Costing Method Absorption Variable 1st Period 2nd Period Total In the first period, production (30,000 units) was greater than sales (28,000), In the second period, production (30,000 units) was less than sales (32,000) For the two-year period, total absorption income and total variable income are the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts