Question: Using all four models in your analysis constant growth model multy stage growth model dividend discount model multiple market approch justifying whether the Companys stock

Using all four models in your analysis

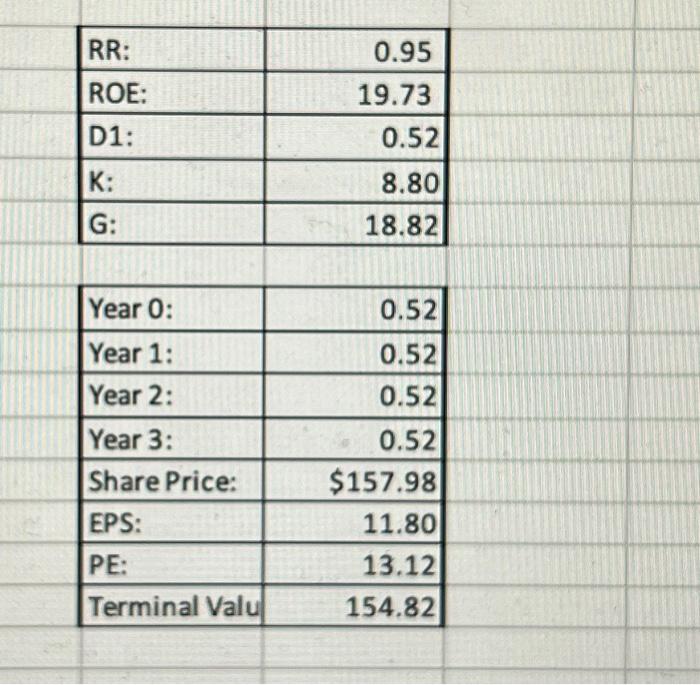

\begin{tabular}{|l|r|} \hline RR: & 0.95 \\ \hline ROE: & 19.73 \\ \hline D1: & 0.52 \\ \hline K: & 8.80 \\ \hline G: & 18.82 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Year 0: & 0.52 \\ \hline Year 1: & 0.52 \\ \hline Year 2: & 0.52 \\ \hline Year 3: & 0.52 \\ \hline Share Price: & $157.98 \\ \hline EPS: & 11.80 \\ \hline PE: & 13.12 \\ \hline Terminal Valu & 154.82 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts