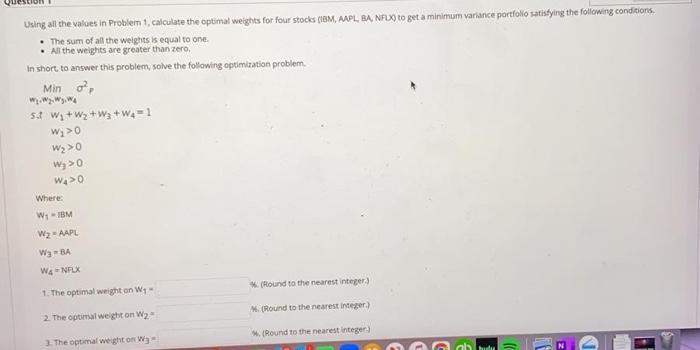

Question: Using all the values in Problem 1, calculate the optimal weights for four stocks (IBM, MPL BA, NFUX) to get a minimum variance portfolio satisfying

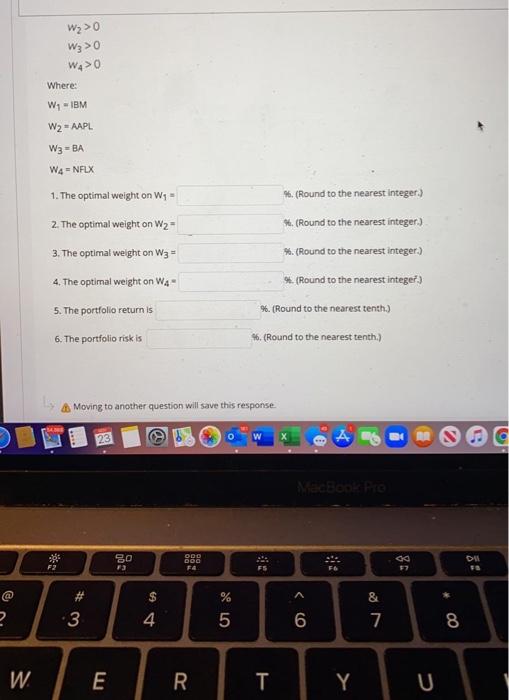

Using all the values in Problem 1, calculate the optimal weights for four stocks (IBM, MPL BA, NFUX) to get a minimum variance portfolio satisfying the following conditions. The sum of all the weights is equal to one All the weights are greater than zero. In short to answer this problem solve the following optimization problem Min , 5.1 W+ W2+W3+W = 1 W;>0 Wy> 0 w > 0 WA> Where: W - IBM W2 - AAPL W3 =BA Wa-NFLX found to the nearest integer) 1. The optimal weight on W M. (Round to the nearest Integer 2. The optimal weight on W2 Round to the nearest Integer 3. The optimal weight on W buda Wy>0 W3 > 0 W>0 Where: W, IBM W2 = AAPL W3 - BA W4 = NFLX 1. The optimal weight on W4 - 46. (Round to the nearest Integer.) 2. The optimal weight on W2" *. (Round to the nearest integer.) *. (Round to the nearest integer.) 4. (Round to the nearest integer.) 3. The optimal welght on W3" 4. The optimal weight on 4- 5. The portfolio return is 6. The portfolio risk is %. (Round to the nearest tenth.) 46. (Round to the nearest tenth.) Moving to another question will save this response. 23 MacBook Pro Ong DOO od D 3 F2 F3 @ $ % & 2 3 4 5 6 7 8 WER Y Using all the values in Problem 1, calculate the optimal weights for four stocks (IBM, MPL BA, NFUX) to get a minimum variance portfolio satisfying the following conditions. The sum of all the weights is equal to one All the weights are greater than zero. In short to answer this problem solve the following optimization problem Min , 5.1 W+ W2+W3+W = 1 W;>0 Wy> 0 w > 0 WA> Where: W - IBM W2 - AAPL W3 =BA Wa-NFLX found to the nearest integer) 1. The optimal weight on W M. (Round to the nearest Integer 2. The optimal weight on W2 Round to the nearest Integer 3. The optimal weight on W buda Wy>0 W3 > 0 W>0 Where: W, IBM W2 = AAPL W3 - BA W4 = NFLX 1. The optimal weight on W4 - 46. (Round to the nearest Integer.) 2. The optimal weight on W2" *. (Round to the nearest integer.) *. (Round to the nearest integer.) 4. (Round to the nearest integer.) 3. The optimal welght on W3" 4. The optimal weight on 4- 5. The portfolio return is 6. The portfolio risk is %. (Round to the nearest tenth.) 46. (Round to the nearest tenth.) Moving to another question will save this response. 23 MacBook Pro Ong DOO od D 3 F2 F3 @ $ % & 2 3 4 5 6 7 8 WER Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts