Question: Using an Aging Schedule to Account for Bad Debts Carter Company sells on credit with terms of n/30. For the $527,000 of accounts at the

Using an Aging Schedule to Account for Bad Debts

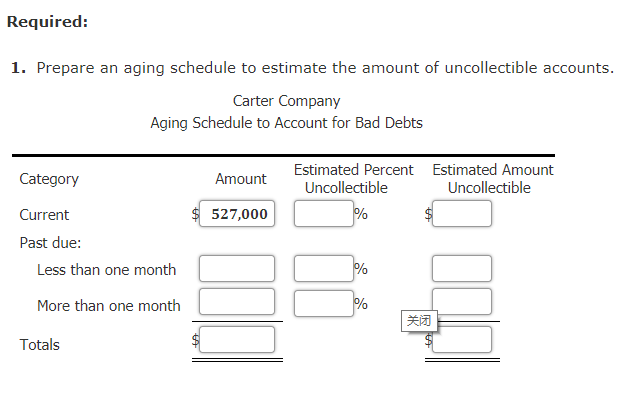

Carter Company sells on credit with terms of n/30. For the $527,000 of accounts at the end of the year that are not overdue, there is a 91% probability of collection. For the $194,000 of accounts that are less than a month past due, Carter estimates the likelihood of collection going down to 74%. The probability of collecting the $101,000 of accounts more than a month past due is estimated to be 26%.

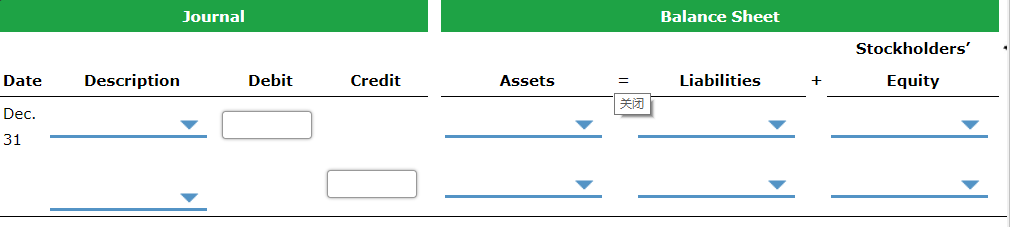

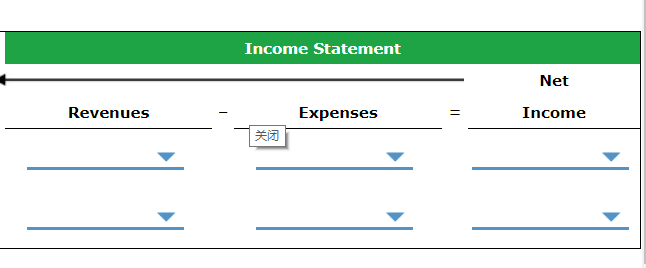

2. On the basis of the schedule in part (1), prepare the journal entry at the end of the year to estimate bad debts. Assume that the credit balance in Allowance for Doubtful Accounts is $19,950. How does this entry affect the accounting equation? Indicate the effect on financial statement items by selecting "" for decrease (or negative effect), "+" for increase (or positive effect) and "NE" for No Entry (or no effect) on the financial statement.

Required 1. Prepare an aging schedule to estimate the amount of uncollectible accounts Carter Company Aging Schedule to Account for Bad Debts Estimated Percent Amont Uncollectible Estimated Amount Uncollectible Category Current Past due: Less than one month More than one month ?? Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts