Question: . . Using an excel workbook (one tab) calculate the following time value of money problems using the PV and FV functions. A few hints

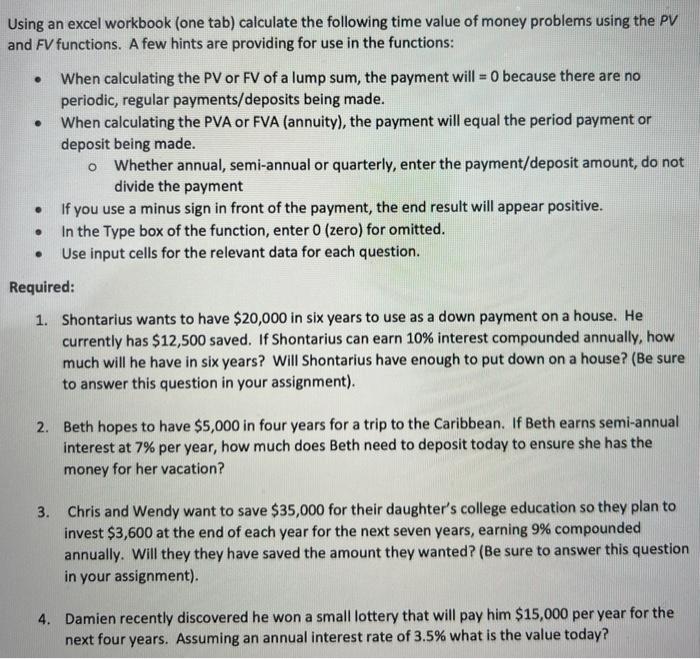

. . Using an excel workbook (one tab) calculate the following time value of money problems using the PV and FV functions. A few hints are providing for use in the functions: When calculating the PV or FV of a lump sum, the payment will = 0 because there are no periodic, regular payments/deposits being made. When calculating the PVA or FVA (annuity), the payment will equal the period payment or deposit being made. o Whether annual, semi-annual or quarterly, enter the payment/deposit amount, do not divide the payment If you use a minus sign in front of the payment, the end result will appear positive. In the Type box of the function, enter 0 (zero) for omitted. Use input cells for the relevant data for each question. . . Required: 1. Shontarius wants to have $20,000 in six years to use as a down payment on a house. He currently has $12,500 saved. If Shontarius can earn 10% interest compounded annually, how much will he have in six years? Will Shontarius have enough to put down on a house? (Be sure to answer this question in your assignment). 2. Beth hopes to have $5,000 in four years for a trip to the Caribbean. If Beth earns semi-annual interest at 7% per year, how much does Beth need to deposit today to ensure she has the money for her vacation? 3. Chris and Wendy want to save $35,000 for their daughter's college education so they plan to invest $3,600 at the end of each year for the next seven years, earning 9% compounded annually. Will they they have saved the amount they wanted? (Be sure to answer this question in your assignment). 4. Damien recently discovered he won a small lottery that will pay him $15,000 per year for the next four years. Assuming an annual interest rate of 3.5% what is the value today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts