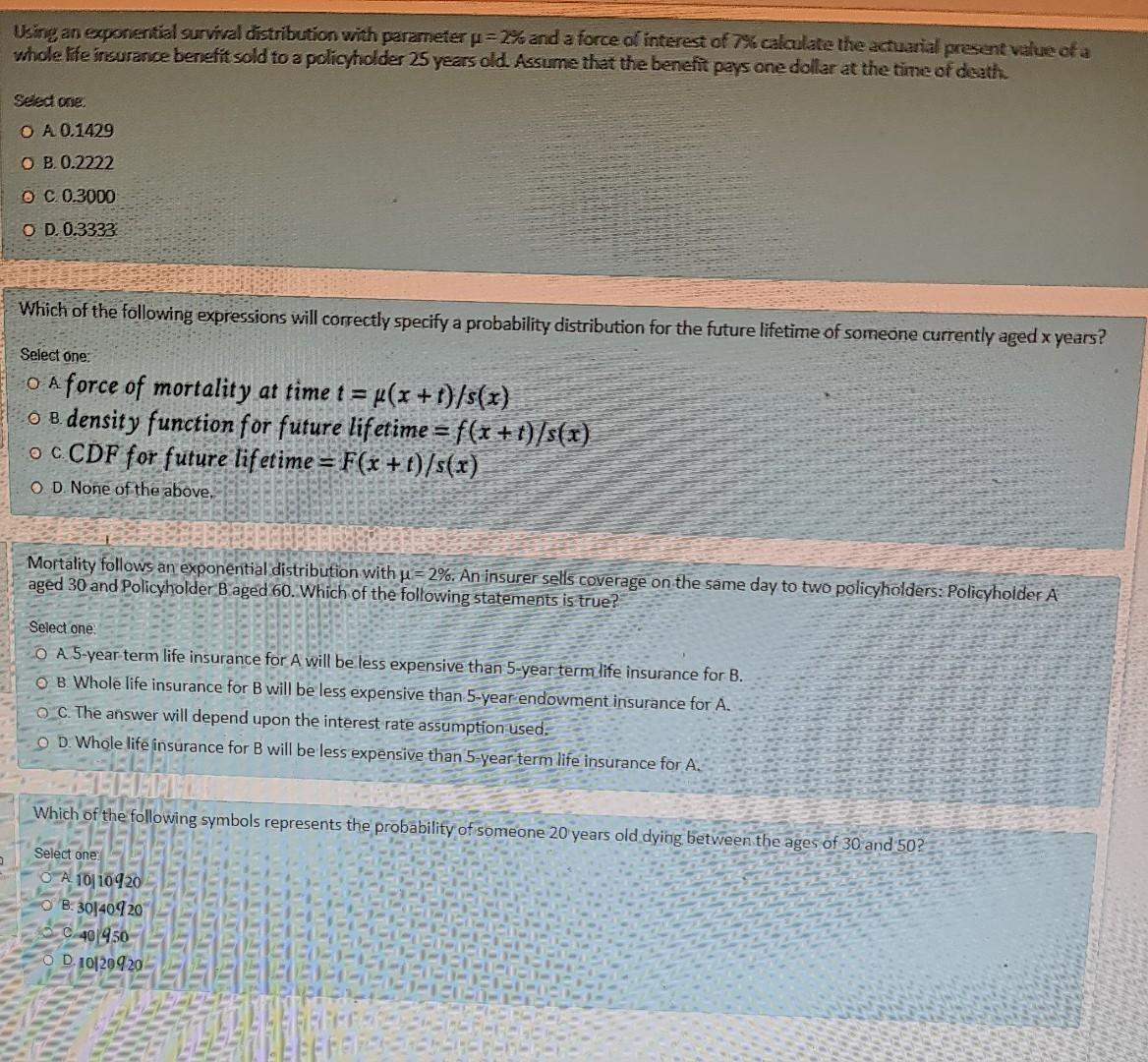

Question: Using an experientiel survival distribution with parameter = 2% and a force of interest of 7% calculate the actuarial present value of a whole life

Using an experientiel survival distribution with parameter = 2% and a force of interest of 7% calculate the actuarial present value of a whole life insurance benefit sold to a policyholder 25 years old. Assume that the benefit pays one dollar at the time of death Select one: O A 0.1429 OB. 0.2222 O C 0.3000 OD. 0.3333 Which of the following expressions will correctly specify a probability distribution for the future lifetime of someone currently aged x years? Select one: O A force of mortality at time t = (x+1)/s(x) o B density function for future lifetime = f(x + 1)/s(x) OCCDF for future lifetime = F(x + t)/s(x) O D. None of the above. Mortality follows an exponential distribution with u =2%. An insurer sells coverage on the same day to two policyholders: Policyholder A aged 30 and Policyholder B aged 60. Which of the following statements is true? Select one O A 5-year term life insurance for A will be less expensive than 5-year term life insurance for B. OB Whole life insurance for B will be less expensive than 5-year endowment insurance for A. O C. The answer will depend upon the interest rate assumption used. O D. Whole life insurance for B will be less expensive than 5-year term life insurance for A. Which of the following symbols represents the probability of someone 20 years old dying between the ages of 30 and 502 Select one: O A 1010920 O B. 3040920 C. 40/450 D. 10120920 Using an experientiel survival distribution with parameter = 2% and a force of interest of 7% calculate the actuarial present value of a whole life insurance benefit sold to a policyholder 25 years old. Assume that the benefit pays one dollar at the time of death Select one: O A 0.1429 OB. 0.2222 O C 0.3000 OD. 0.3333 Which of the following expressions will correctly specify a probability distribution for the future lifetime of someone currently aged x years? Select one: O A force of mortality at time t = (x+1)/s(x) o B density function for future lifetime = f(x + 1)/s(x) OCCDF for future lifetime = F(x + t)/s(x) O D. None of the above. Mortality follows an exponential distribution with u =2%. An insurer sells coverage on the same day to two policyholders: Policyholder A aged 30 and Policyholder B aged 60. Which of the following statements is true? Select one O A 5-year term life insurance for A will be less expensive than 5-year term life insurance for B. OB Whole life insurance for B will be less expensive than 5-year endowment insurance for A. O C. The answer will depend upon the interest rate assumption used. O D. Whole life insurance for B will be less expensive than 5-year term life insurance for A. Which of the following symbols represents the probability of someone 20 years old dying between the ages of 30 and 502 Select one: O A 1010920 O B. 3040920 C. 40/450 D. 10120920

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts