Question: Using Assumption 1, Bonus to AE is? Using assumption 1, Total assets of the partnership after admission of Yessir is? Using Assumption 2, Bonus to

Using Assumption 1, Bonus to AE is?

Using assumption 1, Total assets of the partnership after admission of Yessir is?

Using Assumption 2, Bonus to Yessir is?

Using Assumption 2, Amount that was deducted from Ray's capital is?

Using Assumption 2, Capital balance of Shtern after the admission of Yessir is?

Using Assumtion 3, Change in Shtern's capital after adjustment for revaluation of assets is?

Using Assumption 3, Capital balance of AE immediately after the admission of Yessir is?

Using Assumption 3, Capital balance of Ray after the admission of Yessir is?

Using Assumption 4, Bonus to Shtern is?

Using Assumption 4, Bonus to Yessir is?

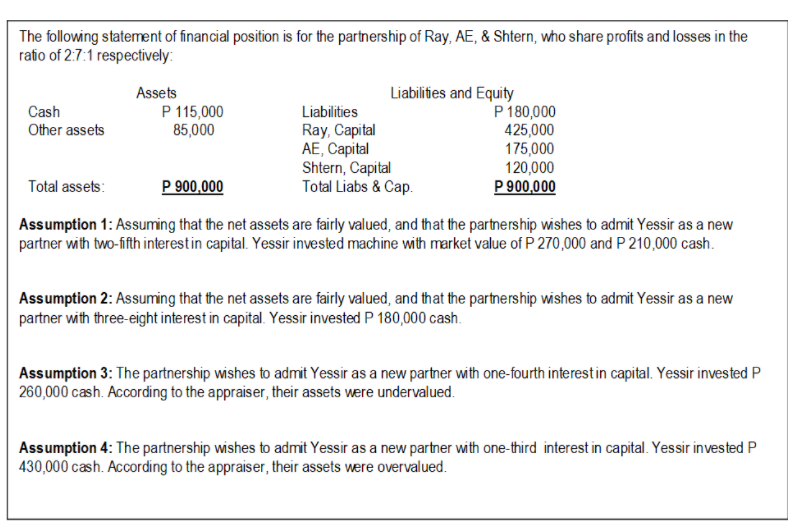

The following statement of financial position is for the partnership of Ray, AE, & Shtern, who share profits and losses in the ratio of 2:7:1 respectively: Assets Liabilities and Equity Cash P 115,000 Liabilities P 180,000 Other assets 85,000 Ray, Capital 425,000 AE, Capital 175,000 Shtern, Capital 120,000 Total assets: P 900,000 Total Liabs & Cap. P 900,000 Assumption 1: Assuming that the net assets are fairly valued, and that the partnership wishes to admit Yessir as a new partner with two-fifth interestin capital. Yessir invested machine with market value of P 270,000 and P 210,000 cash. Assumption 2: Assuming that the net assets are fairly valued, and that the partnership wishes to admit Yessir as a new partner with three-eight interest in capital. Yessir invested P 180,000 cash. Assumption 3: The partnership wishes to admit Yessir as a new partner with one-fourth interest in capital. Yessir invested P 260,000 cash. According to the appraiser, their assets were undervalued. Assumption 4: The partnership wishes to admit Yessir as a new partner with one-third interest in capital. Yessir invested P 430,000 cash. According to the appraiser, their assets were overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts