Question: Using AstraZeneca plcs 2014 annual report and financial statements, explain how an adjusted book value approach to valuing assets and liabilities moves book value nearer

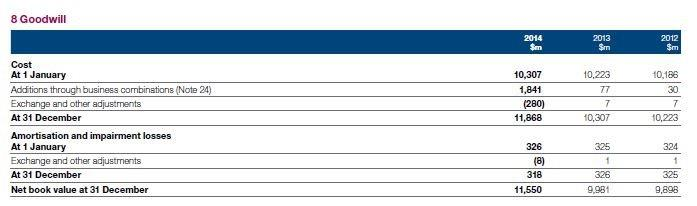

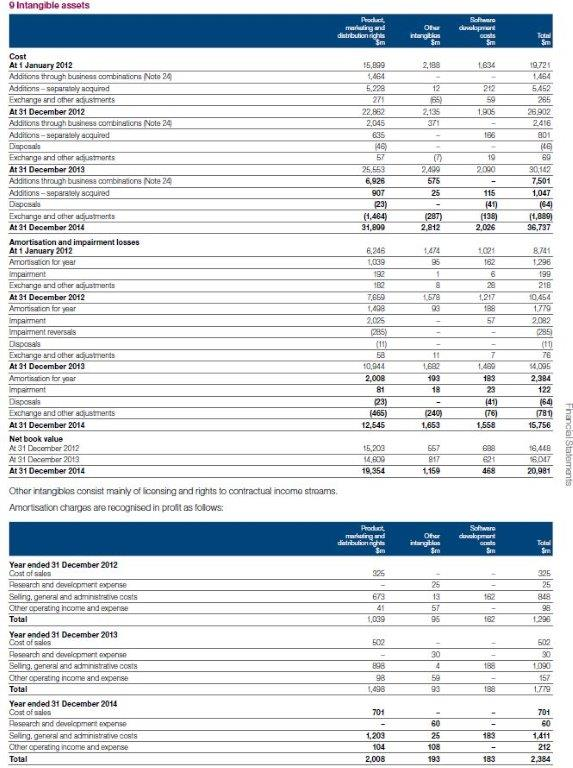

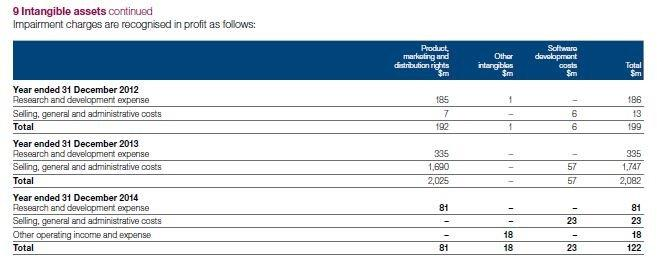

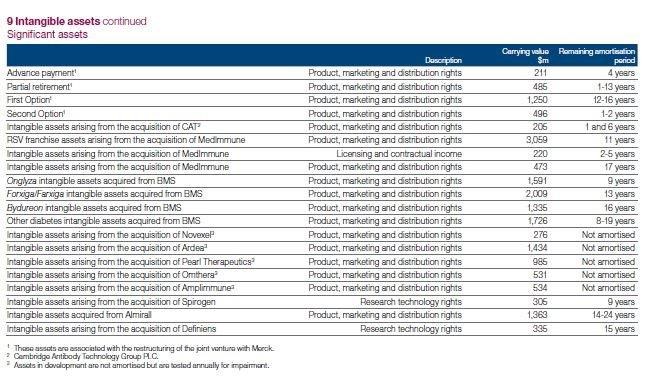

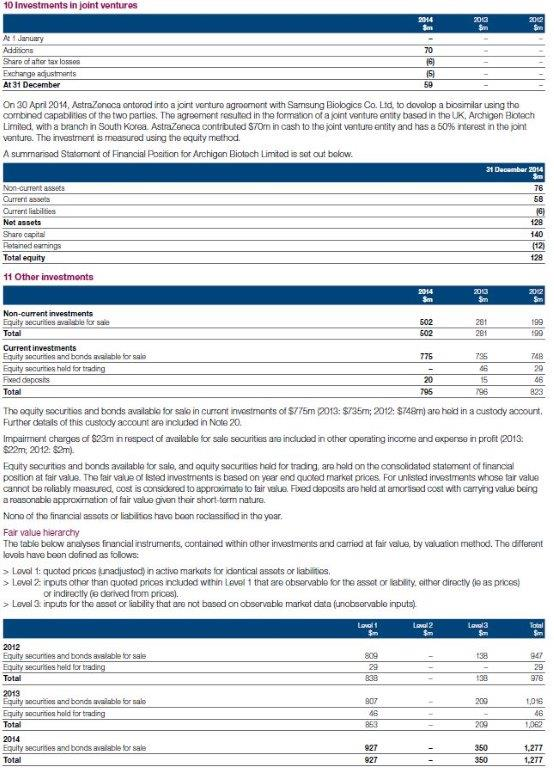

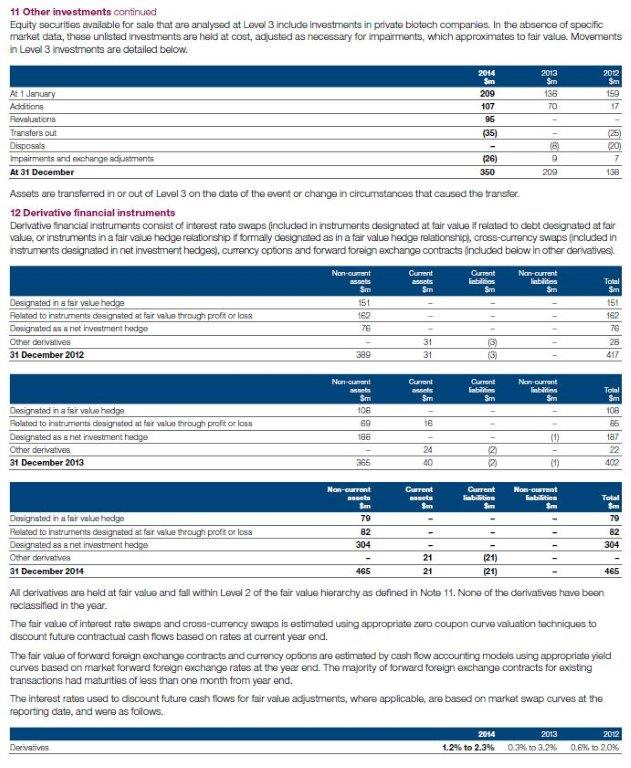

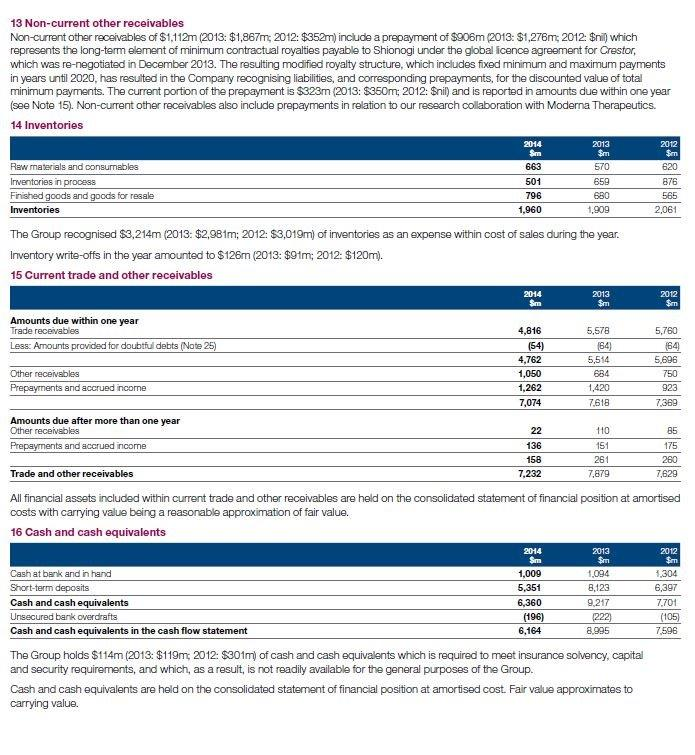

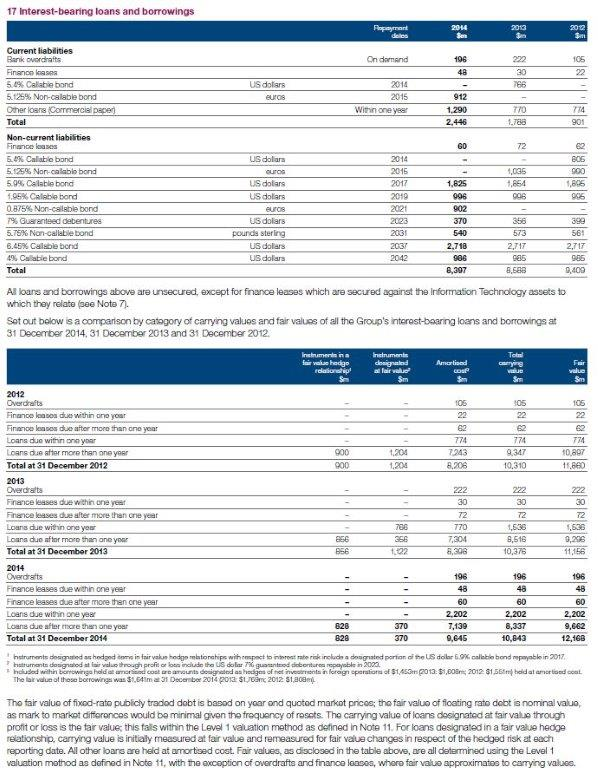

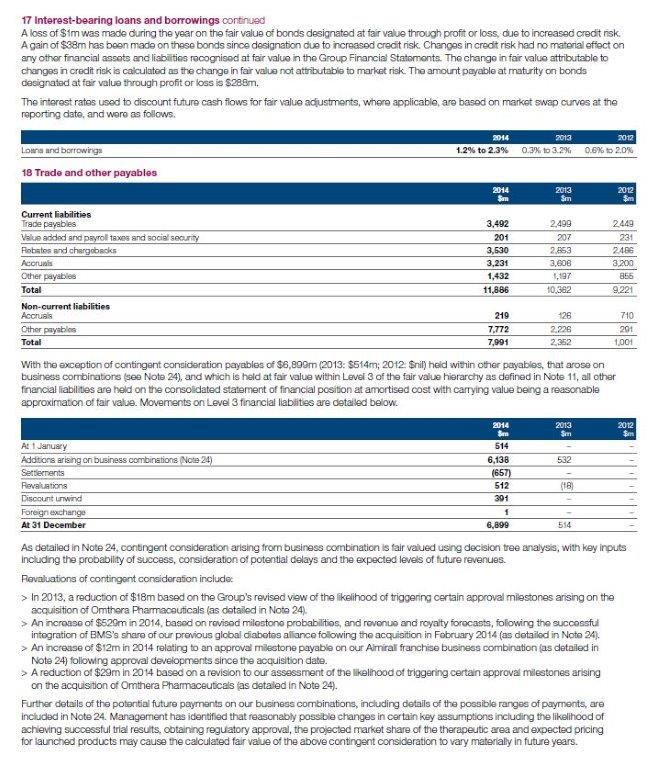

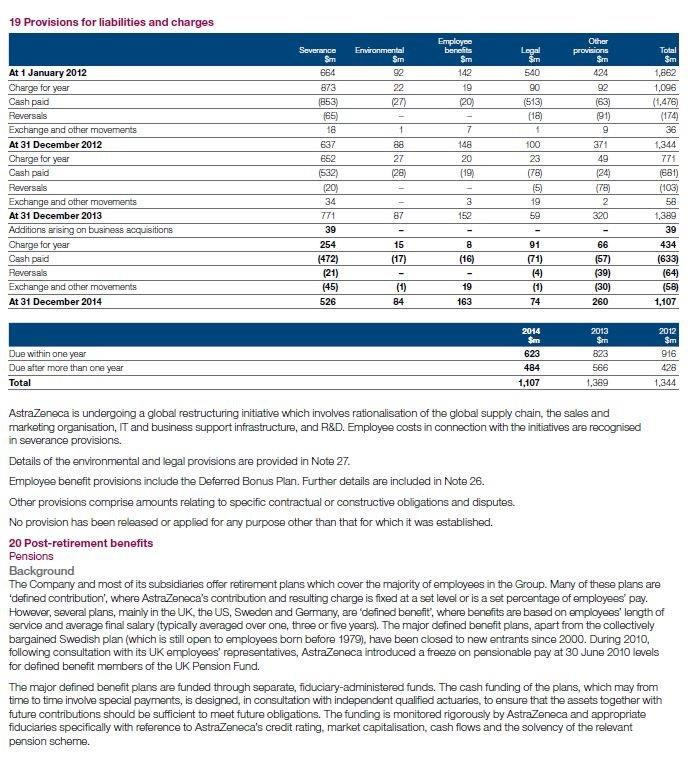

Using AstraZeneca plcs 2014 annual report and financial statements, explain how an adjusted book value approach to valuing assets and liabilities moves book value nearer to economic value.

You are required to provide a written response which highlights four specific items in AstraZeneca plcs balance sheet that might require adjusting to arrive at an economic value.

For each item, explain the type of adjustment and the type of information that might be required before an adjustment could be made to arrive at an economic value for AstraZeneca plc at its 2014 financial year-end.

Calculate the following market multiple ratios for AstraZeneca plc at its 2014 financial year-end:

i.EV/EBITDA

ii.Price-to-earnings ratio (PE ratio)

iii.Price-to-cash-flow ratio

iv.Contrast and explain the results of the different market multiple ratios that you calculated. Evaluate the usefulness of market multiple ratios in company valuation.

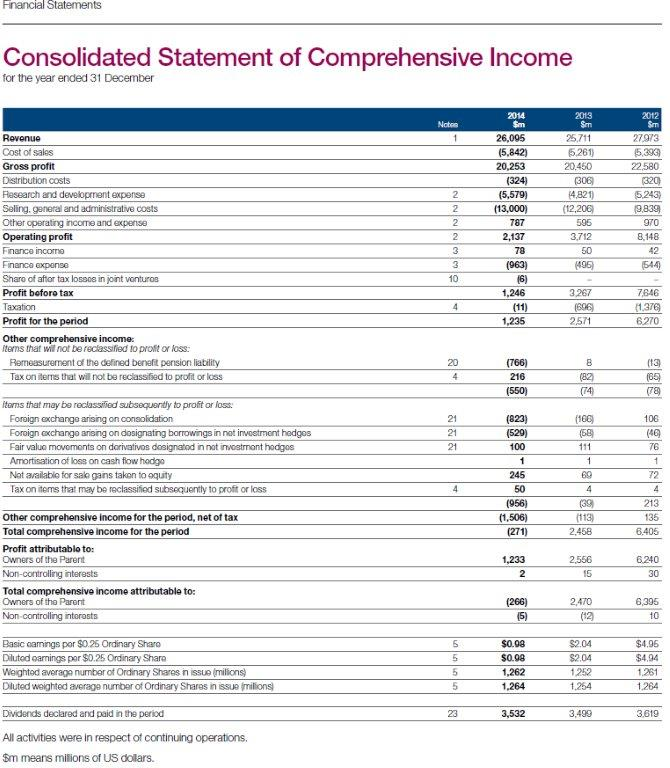

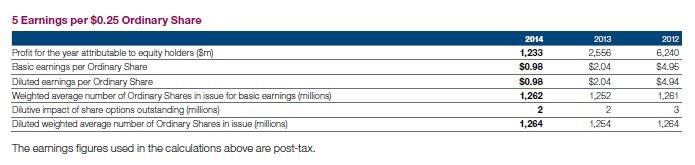

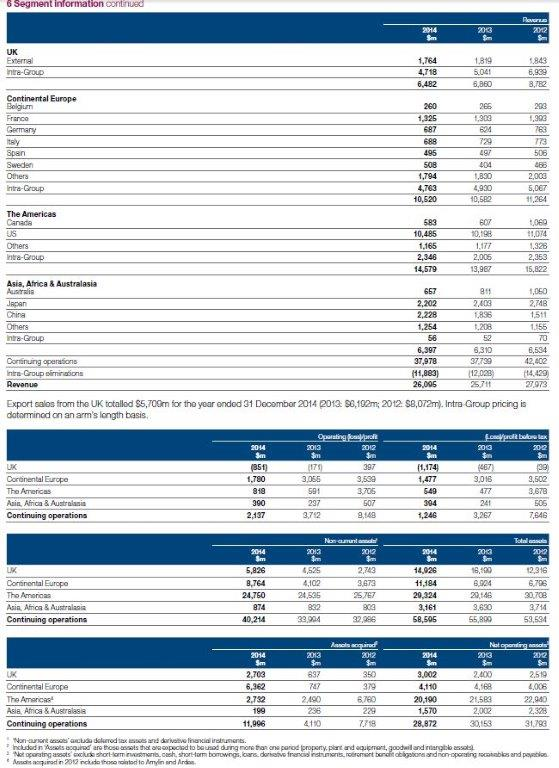

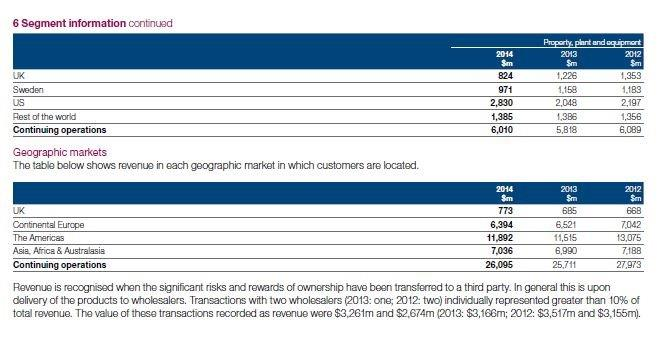

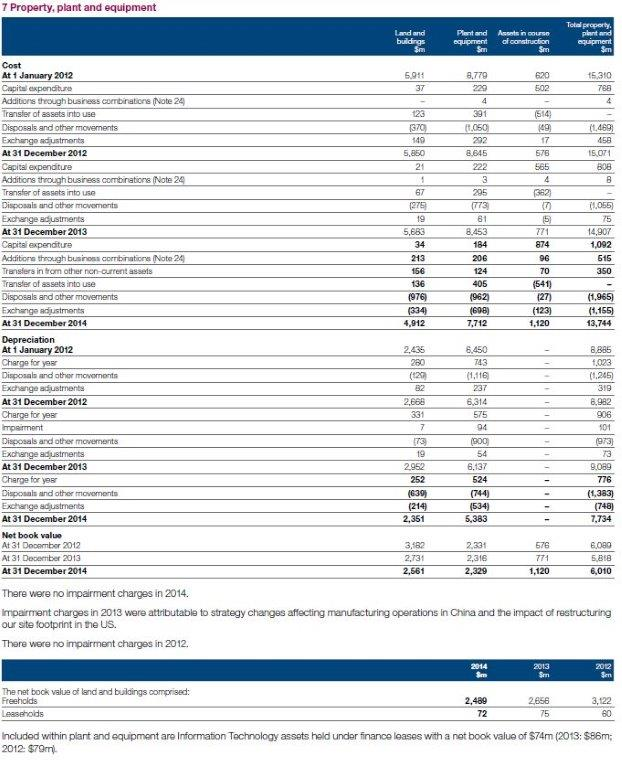

Consolidated Statement of Comprehensive Income for the year ended 31 December 25,711 5,261 20.450 26,095 5,393 22,580 Cost of sales Gross profit Distribution costs Rasearch and development expense Seling. ganeral and admir strative costs Other operating income and expeise Operating profit Finance incomo Financa expense Sharo of aftor tax lossos in joint vonturos Profit boforo tax Taxation Profit for the period 5,842) (5,579) 4.821 9,839 2,137 8,148 50 1,246 3,287 7846 1,235 2571 6270 comprehensive income: terns that wil not be reclassified to proft or loss: (13 Remeasurement of the defined beneft pension liability Tax on iterms that wil not be reclassiied to profit or loss (550) tons that may be reclassified subsequently to profit or loss Foroign exchango arising on conaolidation 106 Foroign exchango arising on dosignating borrowings in not inwostment hedgos Fair valuo movomonts on dorivativos dosignatod in not invostmont hodgos 21 76 Amortisation of loss on cash fow hodgo Not available for salo gans takon to oquity 72 Tax on items that may be reclassified subsequenty to profit or loss (1,506) (271) 113 2,458 213 135 6.405 Other comprehensive income for the period, net of tax Total comprehensive income for the period Profit attributablo to: Owners of the Parent Non-controlling interests Total comprehensive income attributable to: Owners of tho Parent 2,556 15 6.240 30 6,395 10 2,470 Basic camings por $0.25 Ordinary Sharo Diluted oarnings por $0.25 Ordinary Sharo Weightod average number of Ordinary Shares n issue milions Dluted weighted average number of Ordinary Shares in issue milions $0.98 $0.98 1,262 1,264 $2.04 $2.04 1252 1,254 $4.96 $4,04 1.261 1,264 Dividends declared and paid in the period 3,499 3619 All activities were in respect of continuing operations. m means milions of US dolars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts