Question: Using available data in the case, calculate the requested financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05

Using available data in the case, calculate the requested financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05 or 133.

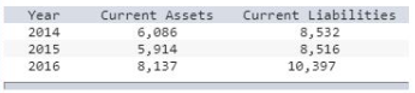

Use the following table to calculate Current Ratios for the years 2014, 2015, and 2016:

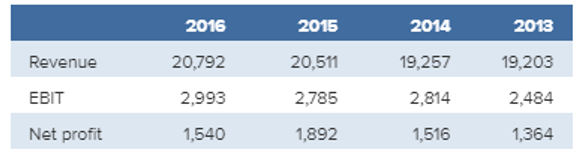

EXHIBIT 1 Income Statement (millions of euros)

EXHIBIT 2 Balance Sheet (millions of euros)

Year 2014 2015 2016 Current Assets 6,086 5,914 8,137 Current Liabilities 8,532 8,516 10,397 ROA ROE Current Ratio 2016 % % 2015 % % 2014 % % Revenue EBIT Net profit 2016 20,792 2,993 1,540 2015 20,511 2,785 1,892 2014 19,257 2,814 1,516 2013 19,203 2,484 1,364 2016 2015 Assets 39,321 40,122 Liabilities 24,748 25,052 Equity 14,573 15,070 2014 2013 34,830 33,337 17,869 17,797 13,452 12,356 2012 35,979 9,260 12,805

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

To calculate the Current Ratios for 2014 2015 and 2016 use the for... View full answer

Get step-by-step solutions from verified subject matter experts