Question: Using average balance sheet figures, as suggested in the chapter, compute the following for the maximum number of years, based on the available data: 1.

Using average balance sheet figures, as suggested in the chapter, compute the following for the

maximum number of years, based on the available data:

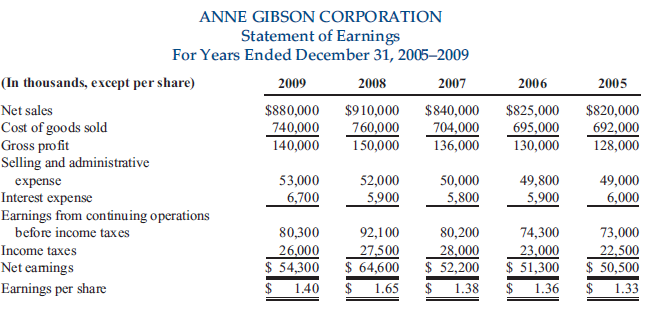

1. Accounts receivable turnover

2. Accounts receivable turnover in days

3. Inventory turnover

4. Inventory turnover in days

5. Operating cycle

6. Working capital

7. Current ratio

8. Acid-test ratio

9. Cash ratio

b. Comment on trends indicated in short-term liquidity.

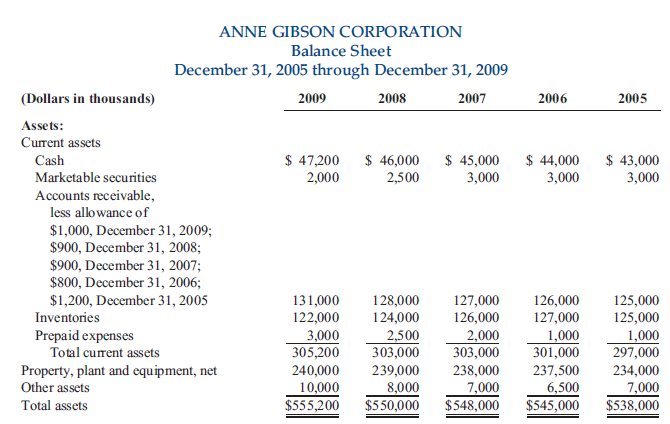

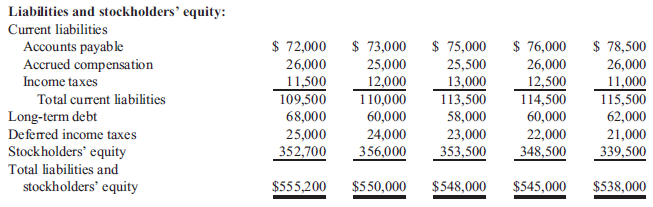

Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued compensation Income taxes Total current liabilities Long-term debt Deferred income taxes Stockholders' equity Total liabilities and stockholders' equity $ 72,000 26,000 11,500 109,500 68,000 25,000 352,700 $ 73,000 25,000 12,000 110,000 60,000 24,000 356,000 $ 75,000 25,500 13,000 113,500 58,000 23,000 353,500 $ 76,000 26,000 12,500 114,500 60,000 22,000 348,500 $ 78,500 26,000 11,000 115,500 62,000 21,000 339,500 $555,200 $550,000 $548,000 $545,000 $538,000 ANNE GIBSON CORPORATION Statement of Earnings For Years Ended December 31, 20052009 (In thousands, except per share) 2009 2008 2007 Net sales $880,000 $910,000 $840,000 Cost of goods sold 740,000 760,000 704,000 Gross profit 140,000 150,000 136,000 Selling and administrative expense 53,000 52,000 50,000 Interest expense 6,700 5,900 5,800 Earnings from continuing operations before income taxes 80,300 92,100 80,200 Income taxes 26,000 27,500 28,000 Net eamings $ 54,300 $ 64,600 $ 52,200 Earnings per share 1.40 $ 1.65 $ 1.38 2006 $825,000 695,000 130,000 2005 $820,000 692,000 128,000 49,800 5,900 49,000 6,000 74,300 23,000 $ 51,300 $ 1.36 73,000 22,500 $ 50,500 $ 1.33 $ Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued compensation Income taxes Total current liabilities Long-term debt Deferred income taxes Stockholders' equity Total liabilities and stockholders' equity $ 72,000 26,000 11,500 109,500 68,000 25,000 352,700 $ 73,000 25,000 12,000 110,000 60,000 24,000 356,000 $ 75,000 25,500 13,000 113,500 58,000 23,000 353,500 $ 76,000 26,000 12,500 114,500 60,000 22,000 348,500 $ 78,500 26,000 11,000 115,500 62,000 21,000 339,500 $555,200 $550,000 $548,000 $545,000 $538,000 ANNE GIBSON CORPORATION Statement of Earnings For Years Ended December 31, 20052009 (In thousands, except per share) 2009 2008 2007 Net sales $880,000 $910,000 $840,000 Cost of goods sold 740,000 760,000 704,000 Gross profit 140,000 150,000 136,000 Selling and administrative expense 53,000 52,000 50,000 Interest expense 6,700 5,900 5,800 Earnings from continuing operations before income taxes 80,300 92,100 80,200 Income taxes 26,000 27,500 28,000 Net eamings $ 54,300 $ 64,600 $ 52,200 Earnings per share 1.40 $ 1.65 $ 1.38 2006 $825,000 695,000 130,000 2005 $820,000 692,000 128,000 49,800 5,900 49,000 6,000 74,300 23,000 $ 51,300 $ 1.36 73,000 22,500 $ 50,500 $ 1.33 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts