Question: USING BLOOMBERG 3. International Portfolio Diversification. Another problem that you encounter in your 5t new position is linked to outdated perceptions of diversification. From your

USING BLOOMBERG

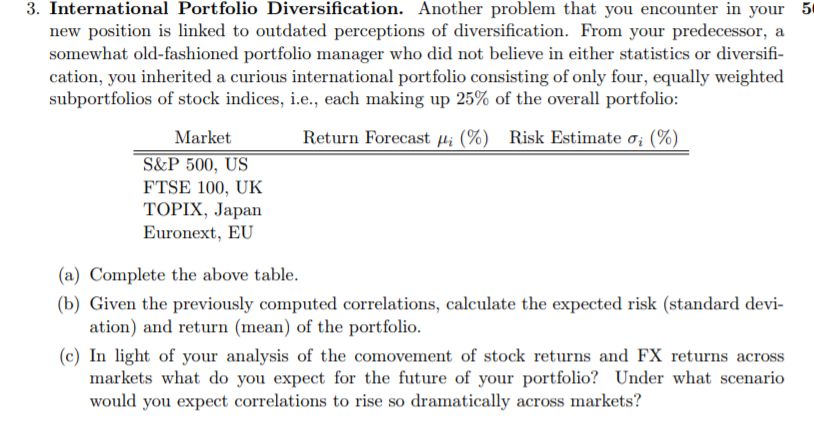

3. International Portfolio Diversification. Another problem that you encounter in your 5t new position is linked to outdated perceptions of diversification. From your predecessor, a somewhat old-fashioned portfolio manager who did not believe in either statistics or diversif- cation, you inherited a curious international portfolio consisting of only four, equally weighted subportfolios of stock indices, i.e., each making up 25% of the overall portfolio: Return Forecast ?? (%) Risk Estimate ?i (%) Market S&P 500, US FTSE 100, UK TOPIX, Japan Euronext, EU (a) Complete the above table. (b) Given the previously computed correlations, calculate the expected risk (standard devi- ation) and return (mean) of the portfolio. (c) In light of your analysis of the comovement of stock returns and FX returns across markets what do you expect for the future of your portfolio? Under what scenario would you expect correlations to rise so dramatically across markets? 3. International Portfolio Diversification. Another problem that you encounter in your 5t new position is linked to outdated perceptions of diversification. From your predecessor, a somewhat old-fashioned portfolio manager who did not believe in either statistics or diversif- cation, you inherited a curious international portfolio consisting of only four, equally weighted subportfolios of stock indices, i.e., each making up 25% of the overall portfolio: Return Forecast ?? (%) Risk Estimate ?i (%) Market S&P 500, US FTSE 100, UK TOPIX, Japan Euronext, EU (a) Complete the above table. (b) Given the previously computed correlations, calculate the expected risk (standard devi- ation) and return (mean) of the portfolio. (c) In light of your analysis of the comovement of stock returns and FX returns across markets what do you expect for the future of your portfolio? Under what scenario would you expect correlations to rise so dramatically across markets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts