Question: Using bootstrap method calculate zero coupon yield curve from coupon bearing bonds. Coupons are paid every half year. They are shown annualized in percent.

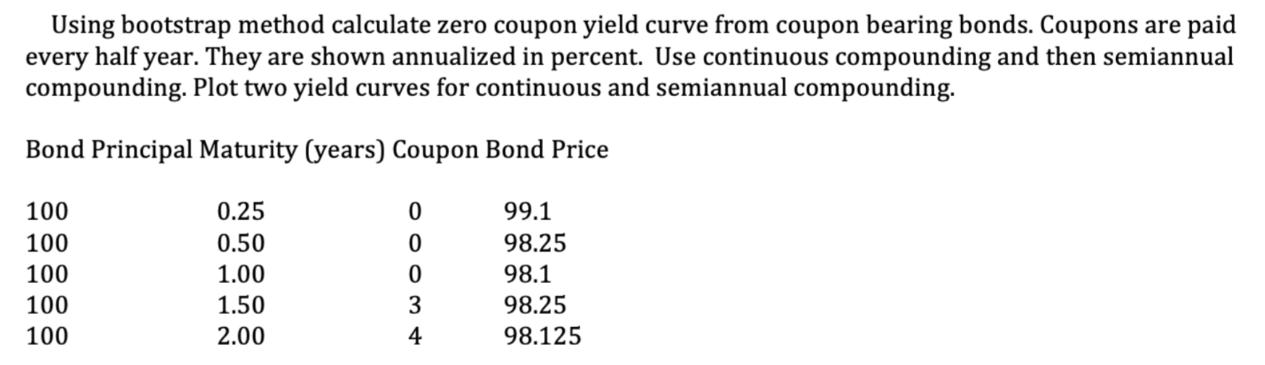

Using bootstrap method calculate zero coupon yield curve from coupon bearing bonds. Coupons are paid every half year. They are shown annualized in percent. Use continuous compounding and then semiannual compounding. Plot two yield curves for continuous and semiannual compounding. Bond Principal Maturity (years) Coupon Bond Price 100 100 100 100 100 0.25 0.50 1.00 1.50 2.00 0 0 0 3 4 99.1 98.25 98.1 98.25 98.125

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Investment yield and factors User Government is selling its 91 days securities with the face value of P1 000 000 fc a What is the yield on the investm... View full answer

Get step-by-step solutions from verified subject matter experts