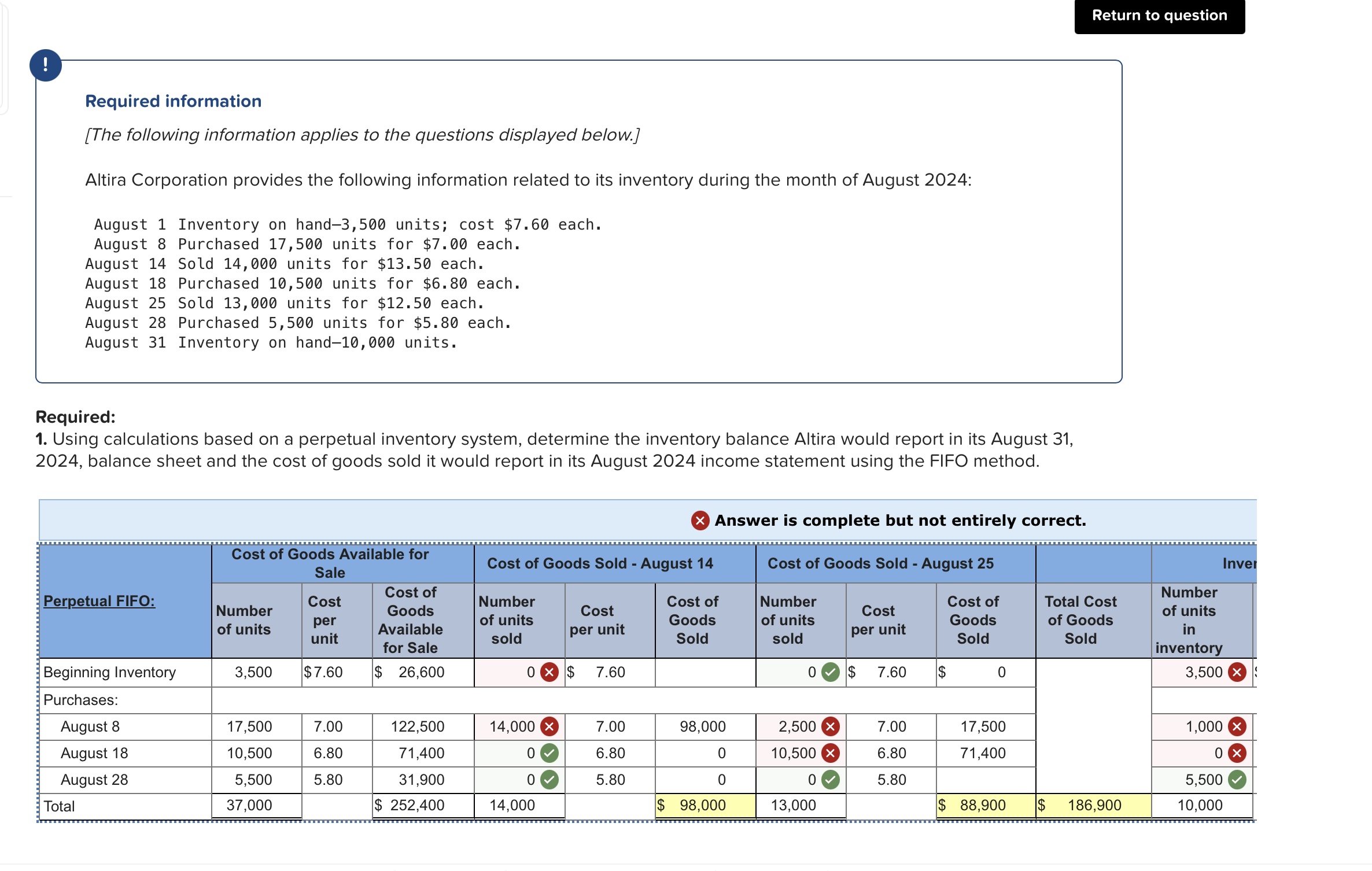

Question: . Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 3 1 , 2 0 2

Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August balance sheet and the cost of goods sold it would report in its August income statement using the FIFO method. Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

ides the following information related to its inventory during the month of August :

on hand units; cost $ each.

units for $ each.

units for $ each.

units for $ each.

units for $ each.

units for $ each.

on hand units.

n a perpetual inventory system, determine the inventory balance Altira would report in its August cost of goods sold it would report in its August income statement using the FIFO method.

Answer is complete but not entirely correct.

begintabularccccccccccccc

hline multicolumnlof Goods Available for Sale & multicolumnlCost of Goods Sold August & multicolumnlCost of Goods Sold August & multirowbTotal Cost of Goods Sold & multicolumncInventory Balance

hline & Cost

per

unit & begintabularc

Cost of

Goods

Available

for Sale

endtabular & Number of units sold & Cost per unit & Cost of Goods Sold & Number of units sold & Cost per unit & Cost of Goods Sold & & Number of units in inventory & Cost per unit & Ending Inventory

hline & $ & $ & times & $ & & $ & $ & $ & & times & $ & $

hline & & & & & & & & & & & &

hline & & & & & & times & & & & & &

hline & & & & & & & & & & times & &

hline & & & times & & & & & & & & &

hline & & $ & & & $ & & & $ & $ & & & $

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock