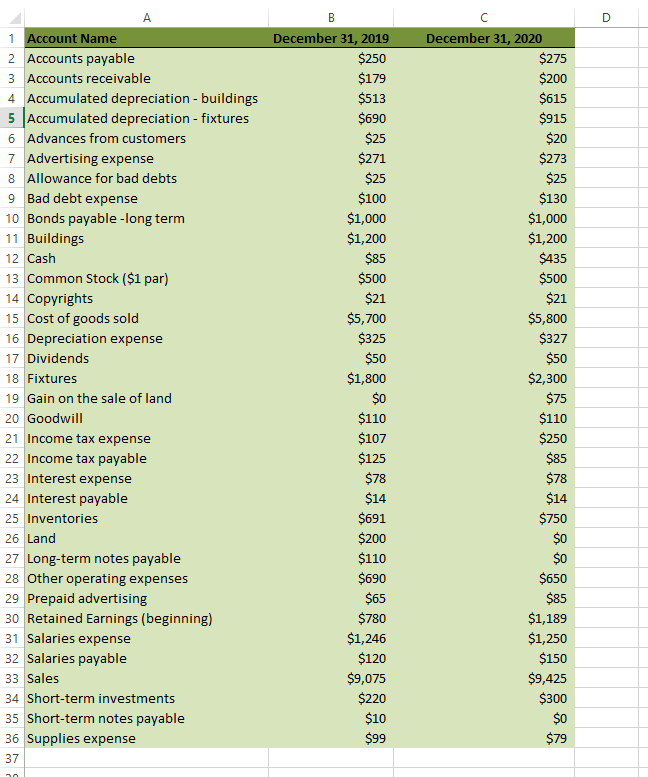

Question: Using Cell references from the account data provided on the project file: 1) Prepare a trial balance in proper order (assets first, liabilities, equity, dividends,

Using Cell references from the account data provided on the project file:

1) Prepare a trial balance in proper order (assets first, liabilities, equity, dividends, revenue, expenses) for 2019 and 2020.

2) Prepare a Income Statements for 2019 and 2020. 3) Prepare a Statement of Retained Earnings for 2019 and 2020. 4) Prepare a Balance Sheet for 2019 and 2020.

5) Prepare a Statement of Cash Flows for 2020 only. Fixtures were purchased for cash and some of the cash from the land sale was use to pay off debt and buy investments.

Check figures:

Total assets: 2019: $3,343; 2020:$3,846

Net Income: 2019: $459; 2020: $663

Equity 2019: $1189; 2020: $1802

Ending cash C/F statement = $435

A B D 1 Account Name 2 Accounts payable 3 Accounts receivable 4 Accumulated depreciation - buildings 5 Accumulated depreciation - fixtures 6 Advances from customers 7 Advertising expense 8 Allowance for bad debts 9 Bad debt expense 10 Bonds payable-long term 11 Buildings 12 Cash 13 Common Stock ($1 par) 14 Copyrights 15 Cost of goods sold 16 Depreciation expense 17 Dividends 18 Fixtures 19 Gain on the sale of land 20 Goodwill 21 Income tax expense 22 Income tax payable 23 Interest expense 24 Interest payable 25 Inventories 26 Land 27 Long-term notes payable 28 Other operating expenses 29 Prepaid advertising 30 Retained Earnings (beginning) 31 Salaries expense 32 Salaries payable 33 Sales 34 Short-term investments 35 Short-term notes payable 36 Supplies expense 37 December 31, 2019 $250 $179 $513 $690 $25 $271 $25 $100 $1,000 $1,200 $85 $500 $21 $5,700 $325 $50 $1,800 $0 $110 $107 $125 $78 $14 $691 $200 $110 $690 $65 $780 $1,246 $120 $9,075 $220 $10 $99 December 31, 2020 $275 $200 $615 $915 $20 $273 $25 $130 $1,000 $1,200 $435 $500 $21 $5,800 $327 $50 $2,300 $75 $110 $250 $85 $78 $14 $750 $0 $0 $650 $85 $1,189 $1,250 $150 $9,425 $300 $0 $79 A B D 1 Account Name 2 Accounts payable 3 Accounts receivable 4 Accumulated depreciation - buildings 5 Accumulated depreciation - fixtures 6 Advances from customers 7 Advertising expense 8 Allowance for bad debts 9 Bad debt expense 10 Bonds payable-long term 11 Buildings 12 Cash 13 Common Stock ($1 par) 14 Copyrights 15 Cost of goods sold 16 Depreciation expense 17 Dividends 18 Fixtures 19 Gain on the sale of land 20 Goodwill 21 Income tax expense 22 Income tax payable 23 Interest expense 24 Interest payable 25 Inventories 26 Land 27 Long-term notes payable 28 Other operating expenses 29 Prepaid advertising 30 Retained Earnings (beginning) 31 Salaries expense 32 Salaries payable 33 Sales 34 Short-term investments 35 Short-term notes payable 36 Supplies expense 37 December 31, 2019 $250 $179 $513 $690 $25 $271 $25 $100 $1,000 $1,200 $85 $500 $21 $5,700 $325 $50 $1,800 $0 $110 $107 $125 $78 $14 $691 $200 $110 $690 $65 $780 $1,246 $120 $9,075 $220 $10 $99 December 31, 2020 $275 $200 $615 $915 $20 $273 $25 $130 $1,000 $1,200 $435 $500 $21 $5,800 $327 $50 $2,300 $75 $110 $250 $85 $78 $14 $750 $0 $0 $650 $85 $1,189 $1,250 $150 $9,425 $300 $0 $79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts