Question: Using consumer Loans Back to Q Search this con An Average 074 7. Cho7 Financial Planning Exercise & eBook Chapter 7 Financial Planning Exercise 8

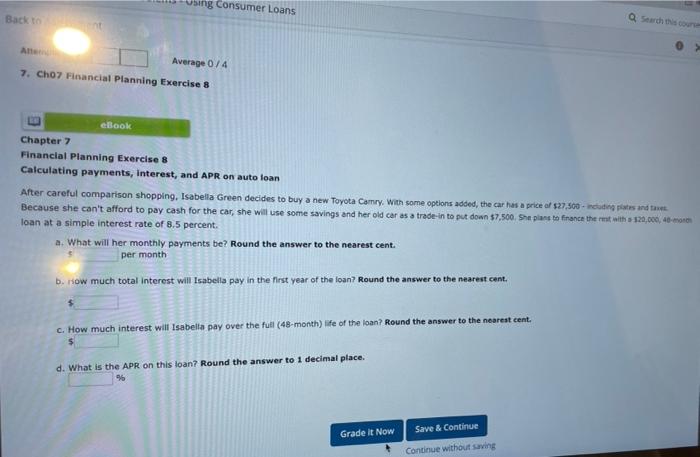

Using consumer Loans Back to Q Search this con An Average 074 7. Cho7 Financial Planning Exercise & eBook Chapter 7 Financial Planning Exercise 8 Calculating payments, Interest, and APR on auto loan After careful comparison shopping. Isabella Green decides to buy a new Toyota Camry. With some options added, the car has a price of $27.500 - dating plates and Because she can't afford to pay cash for the car, she will use some savings and her old car as a trade-in to put down $7,500. She plans to finance the most with 120,000, 4-monn loan at a simple interest rate of 8.5 percent. a. What will her monthly payments be? Round the answer to the nearest cent. per month b. How much total interest will Isabella pay in the first year of the loan? Round the answer to the nearest cent. C. How much interest will Isabella pay over the full (48-month) life of the loan? Round the answer to the nearest cent. d. What is the APR on this loan? Round the answer to 1 decimal place, Grade it Now Save & Continue Continue without Saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts