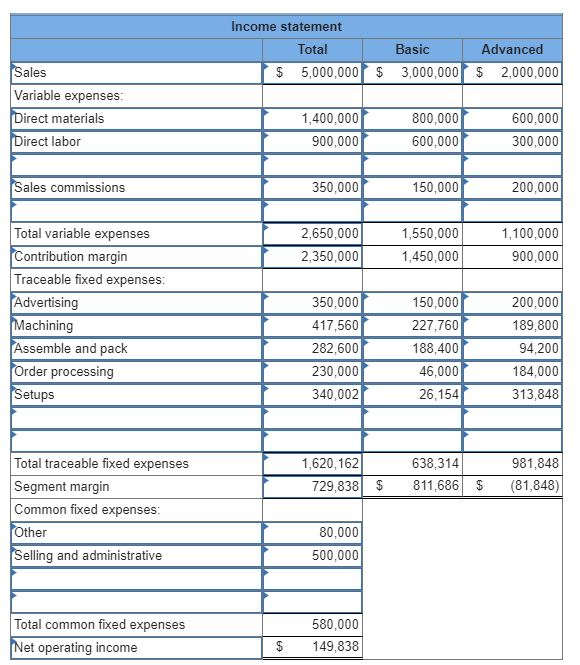

Question: Using contribution format segmented income statement, calculate the break-even point in dollar sales for the Advanced model. Income statement Total $ 5,000,000 Basic 3,000,000 Advanced

Using contribution format segmented income statement, calculate the break-even point in dollar sales for the Advanced model.

Income statement Total $ 5,000,000 Basic 3,000,000 Advanced $ 2,000,000 $ Sales Variable expenses Direct materials Direct labor 1,400,000 900,000 800,000 600,000 600,000 300,000 Sales commissions 350,000 150,0001 200,000 2,650,000 2,350,000 1,550,000 1,450,000 1,100,000 900,000 Total variable expenses Contribution margin Traceable fixed expenses: Advertising Machining Assemble and pack Order processing Setups 350,000 417,560 282,600 230,000 340,002 150,000 227,760 188,400 46,000 26,154 200,000 189,800 94,200 184,000 313,848 1,620,162 729,838) $ 638,314 811,686 981,848 (81,848) $ Total traceable fixed expenses Segment margin Common fixed expenses: Other Selling and administrative 80,000 500,000 Total common fixed expenses Net operating income 580,000 149,838 | $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts