Question: Using duration to Estimate Loan Risk How they find Spread and Fees? Using Duration to Estimate Loan Risk (Example) Suppose an Fl wants to evaluate

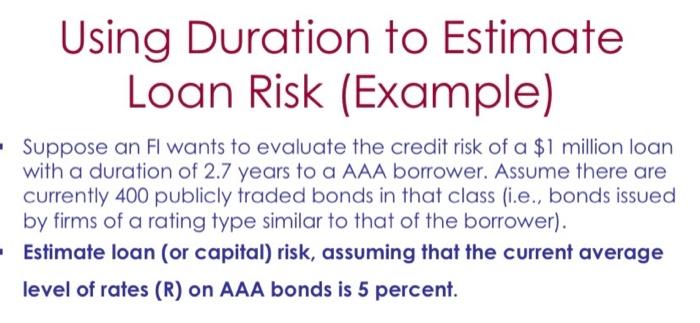

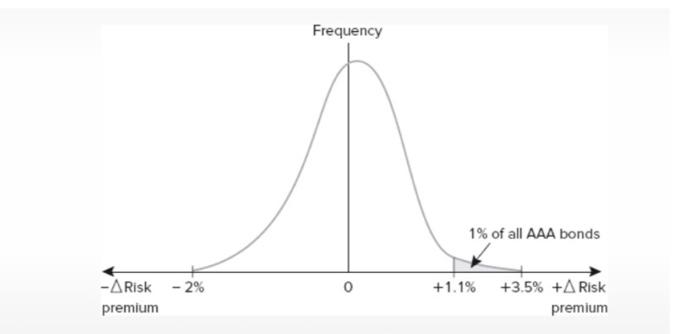

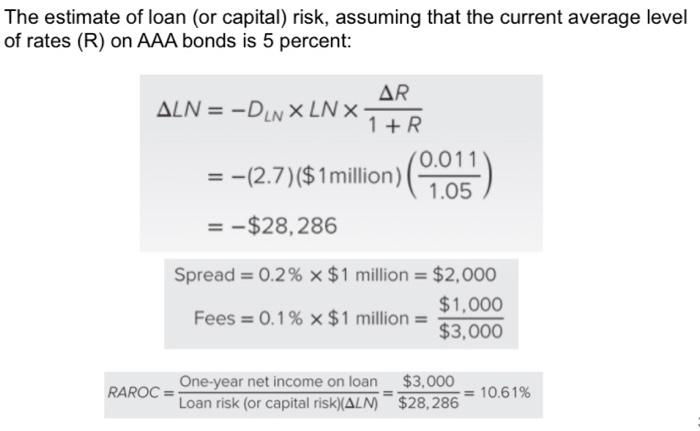

Using Duration to Estimate Loan Risk (Example) Suppose an Fl wants to evaluate the credit risk of a $1 million loan with a duration of 2.7 years to a AAA borrower. Assume there are currently 400 publicly traded bonds in that class (i.e., bonds issued by firms of a rating type similar to that of the borrower). Estimate loan (or capital) risk, assuming that the current average level of rates (R) on AAA bonds is 5 percent. The estimate of loan (or capital) risk, assuming that the current average level of rates (R) on AAA bonds is 5 percent: LN=DLNLN1+RR=(2.7)($1million)(1.050.011)=$28,286 Spread=0.2%$1million=$2,000Fees=0.1%$1million=$3,000$1,000 RAROC=Loanrisk(orcapitalrisk)(LM)One-yearnetincomeonloan=$28,286$3,000=10.61%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts