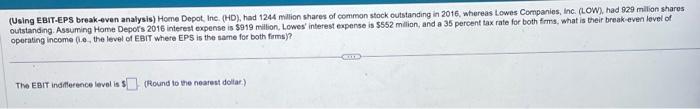

Question: (Using EBrT-EPS break-oven analysis) Home Depot. Ine. (HD), had 1244 million shares of common stock outstanding in 2016, whereas Lowes Companies, Inc. (LOW), had 929

(Using EBrT-EPS break-oven analysis) Home Depot. Ine. (HD), had 1244 million shares of common stock outstanding in 2016, whereas Lowes Companies, Inc. (LOW), had 929 million shares outstanding. Assuming Home Depors 2016 interest expense is $919 million, Lowes' interest expense is $552 millian, and a 35 percent tax rate for both frms, what is their break-even level of operating income (1.e, the level of EBIT where EPS is the sarne for both farms)? The EBIT indiflerence level is s (Rowind to the nearest dolar)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock