Question: Using EDGAR (Electronic Data Gathering, Analysis, and Retrieval system), find the annual report (10-K) for Abercrombie & Fitch Company for the year ended February 1,

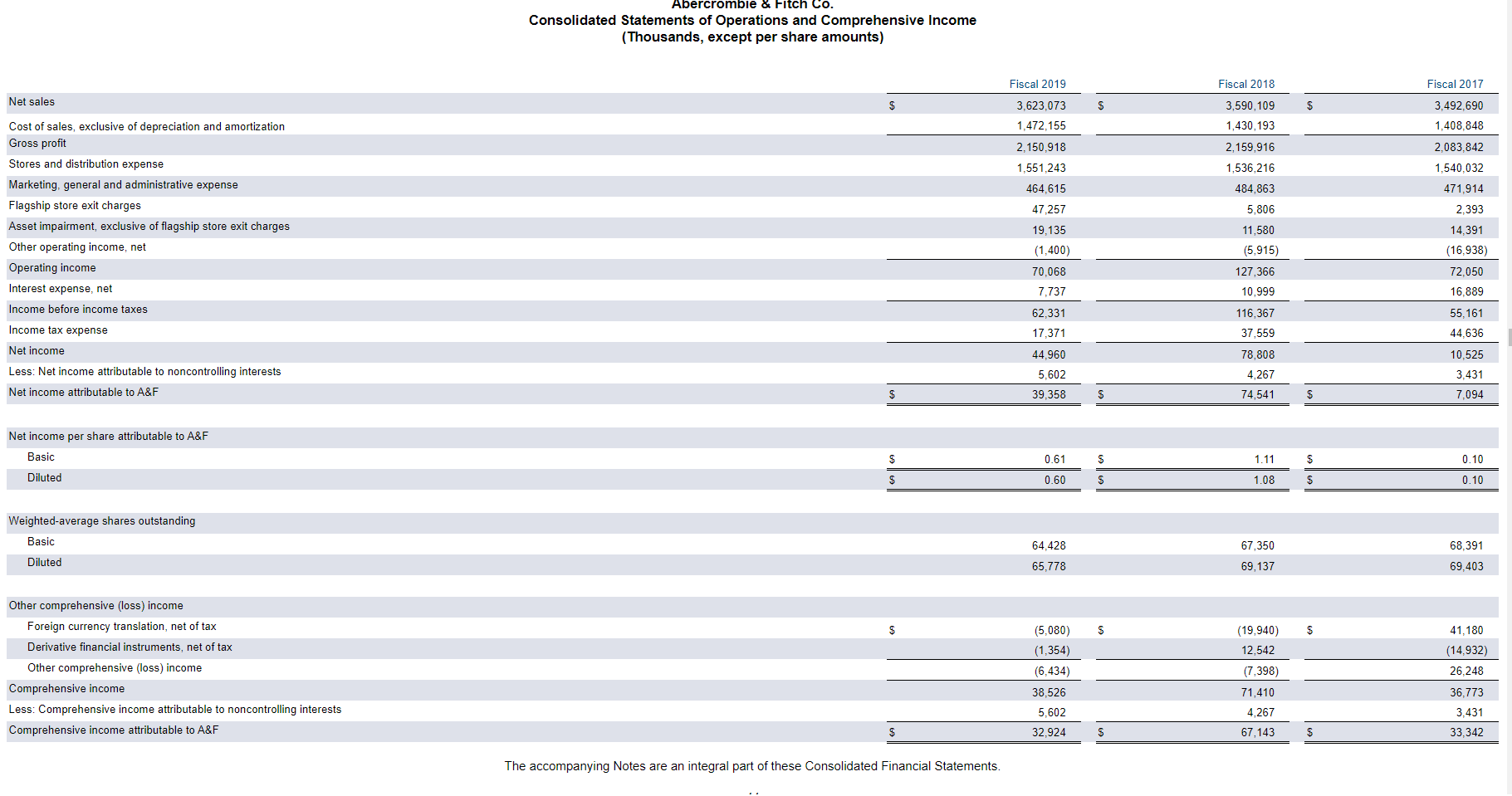

Using EDGAR (Electronic Data Gathering, Analysis, and Retrieval system), find the annual report (10-K) for Abercrombie & Fitch Company for the year ended February 1, 2020. Locate the Consolidated Statements of Operations and Comprehensive Income (income statement) and Consolidated Balance Sheets. You may also find the annual report at the companys website. Required:

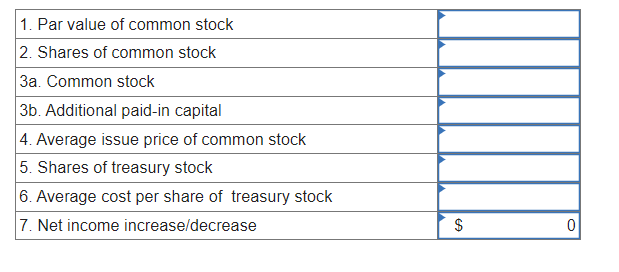

1. From the equity section of the balance sheet, determine the par value of the companys common stock. (Round your answer to 2 decimal places.) 2. How many shares of common stock have been issued? 3. What is the reported amount of common stock and additional paid-in capital (listed as paid-in capital)? 4. Using your answers in requirements 2 and 3, determine the average issue price of common stock. (Round your answer to 2 decimal places.) 5. How many shares of treasury stock is the company holding by the end of the most recent year? 6. Using the balance of treasury stock and your answer in requirement 5, determine the average cost per share of treasury stock. (Round your answer to 2 decimal places.) 7. If the company were to sell all of its treasury stock for $2,000,000 (in thousands), by how much would net income increase/decrease?

Please Explain, Thank you!

\begin{tabular}{|l|l|} \hline 1. Par value of common stock & \\ \hline 2. Shares of common stock & \\ \hline 3a. Common stock & \\ \hline 3b. Additional paid-in capital & \\ \hline 4. Average issue price of common stock & \\ \hline 5. Shares of treasury stock & \\ \hline 6. Average cost per share of treasury stock & $ \\ \hline 7. Net income increase/decrease & 0 \\ \hline \end{tabular} Abercrombie \& Fitch Co. Consolidated Statements of Operations and Comprehensive Income (Thousands, except per share amounts) Assets Current assets: \begin{tabular}{|c|c|c|c|c|} \hline Cash and equivalents & $ & 671,267 & $ & 723,135 \\ \hline Receivables & & 80,251 & & 73,112 \\ \hline Inventories & & 434,326 & & 437,879 \\ \hline Other current assets & & 78,905 & . & 101,824 \\ \hline Total current assets & & 1,264,749 & & 1,335,950 \\ \hline Property and equipment, net & & 665,290 & & 694,855 \\ \hline Operating lease right-of-use assets & & 1,230,954 & & - \\ \hline Other assets & & 388,672 & & 354,788 \\ \hline Total assets & $ & 3,549,665 & $ & 2,385,593 \\ \hline \multicolumn{5}{|l|}{ Liabilities and stockholders' equity. } \\ \hline \multicolumn{5}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $ & 219,919 & $ & 226,878 \\ \hline Accrued expenses & & 302,214 & & 293,579 \\ \hline Short-term portion of operating lease liabilities & & 282,829 & & - \\ \hline Income taxes payable & & 10,392 & & 18,902 \\ \hline Short-term portion of deferred lease credits & & - & & 19,558 \\ \hline Total current liabilities & & 815,354 & & 558,917 \\ \hline \multicolumn{5}{|l|}{ Long-term liabilities: } \\ \hline Long-term portion of operating lease liabilities & & 1,252,634 & & - \\ \hline Long-term portion of borrowings, net & & 231,963 & & 250,439 \\ \hline Long-term portion of deferred lease credits & & - & & 76,134 \\ \hline Leasehold financing obligations & & - & & 46,337 \\ \hline Other liabilities & & 178,536 & & 235,145 \\ \hline Total long-term liabilities & & 1,663,133 & & 608,055 \\ \hline \multicolumn{5}{|l|}{ Stockholders' equity } \\ \hline Class A Common Stock - $0.01 par value: 150,000 shares authorized and 103,300 shares issued at each of February 1,2020 and February 2, 2019 & & 1,033 & & 1,033 \\ \hline Paid-in capital & & 404,983 & & 405,379 \\ \hline Retained earnings & & 2,313,745 & & 2,418,544 \\ \hline Accumulated other comprehensive loss, net of tax ("AOCL") & & (108,886) & & (102,452) \\ \hline Treasury stock, at average cost: 40,514 and 37,073 shares at February 1, 2020 and February 2, 2019, respectively & & (1,552,065) & & (1,513,604) \\ \hline Total Abercrombie \& Fitch Co. stockholders' equity & & 1,058,810 & & 1,208,900 \\ \hline Noncontrolling interests & & 12,368 & & 9,721 \\ \hline Total stockholders' equity & & 1,071,178 & & 1,218,621 \\ \hline Total liabilities and stockholders' equity & $ & 3,549,665 & $ & 2,385,593 \\ \hline \end{tabular} The accompanying Notes are an integral part of these Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts