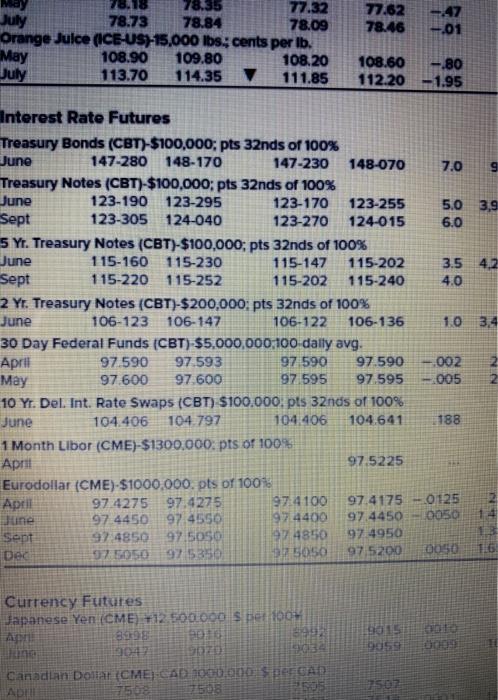

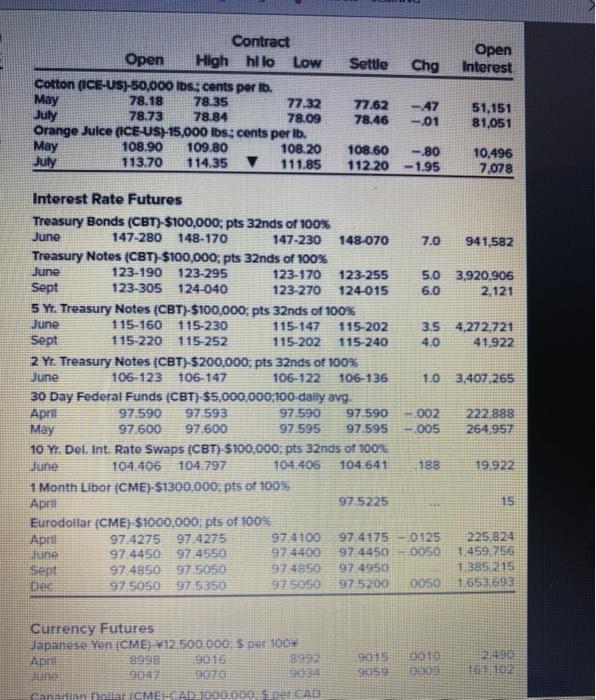

Question: Using Eigure 141 You are short 10 September 2019 five-year Treasury note futures contracts. Calculate your profit or loss from this trading day (A negative

Using Eigure 141 You are short 10 September 2019 five-year Treasury note futures contracts. Calculate your profit or loss from this trading day (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) Gain/Loss of July 77.62 78.46 -.01 78.18 78.35 77.32 78.73 78.84 78.09 Orange Juice (ICE-US)-15,000 lbs., cents per lb. May 108.90 109.80 108.20 July 113.70 114.35 111.85 108.60 -.80 112.20 -1.95 7.0 5.0 3,9 6.0 3.5 4.2 4.0 10 3,4 Interest Rate Futures Treasury Bonds (CBT)-$100,000; pts 32nds of 100% June 147-280 148-170 147-230 148-070 Treasury Notes (CBT) $100,000; pts 32nds of 100% June 123-190 123-295 123-170 123-255 Sept 123-305 124-040 123-270 124-015 5 Yr. Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 115-160 115-230 115-147 115-202 Sept 115-220 115-252 115-202 115-240 2 Yr. Treasury Notes (CBT)-$200,000; pts 32nds of 100% June 106-123 106-147 106-122 106-136 30 Day Federal Funds (CBT) $5,000,000,100 daily avg. April 97.590 97.593 97 590 97.590 May 97 600 97.600 97 595 97.595 10 Yr. Del. Int. Rate Swaps (CBT) $100.000, pts 32nds of 100% June 104.406 104.797 104,406 104.641 1 Month Libor (CME)-$1300,000; pts of 1004 April 97.5225 Eurodollar (CME)-$1000,000. pts of 1001 April 97 4275 97.4275 974100 97.4175 June 97.4450 97 4550 97 4400 97 4450 Sept 97 4850 97 5050 974850 97 4950 Dec 97 5350 5050 97 5200 002 2005 NN 188 0125 0050 0050 Currency Futures Japanese Yen (CME) +12.500.000 $ per 100% 901 905 3 CO Canadian Dollar CME-CAD 1000.000 per CAD April 7508 750 Settle Chg Open Interest Contract Open High hilo Low Cotton (ICE-US)-50,000 lbs.; cents per b. May 78.18 78.35 77.32 July 78.73 78.84 78.09 Orange Juice (ICE-US)-15,000 lbs.; cents per ib. May 108.90 109.80 108.20 July 113.70 114.35 111.85 77.62 78.46 -47 -01 51,151 81,051 108.60 112.20 -80 -1.95 10.496 7,078 Interest Rate Futures Treasury Bonds (CBT) $100,000: pts 32nds of 100% June 147-280 148-170 147-230 148-070 7.0 941,582 Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 123-190 123-295 123-170 123-255 5.0 3,920.906 Sept 123-305 124-040 123-270 124-015 6.0 2.121 5 Y. Treasury Notes (CBT)-$100,000pts 32nds of 100% June 1 15-160 115-230 115-147 115-202 3.5 4.272,721 Sept 115-220 1 15-252 115-202 115-240 4.0 41.922 2 Yt. Treasury Notes (CBT)-$200,000; pts 32nds of 100% June 106-123 106-147 106-122 106-136 1.0 3,407,265 30 Day Federal Funds (CBT) $5,000,000,100 daily avg. Apr 97.590 97 593 97 590 97 590 002 222.888 97.600 97.600 97.595 97.595 -005 264,957 10 M. Del. Int. Rate Swaps (CBT) $100,000, pts 32nds of 100% June 104.406 104.797 104.406 104.641 188 19.922 1 Month Libor (CME) $1300,000. pts of 100% April 97 5225 15 Eurodollar (CME) $1000,000. pts of 100% April 97.4275 97 4275 97.4100 97-4175 - 0125 225 824 Jane 97 4450 97 4550 97 4400 97 4450 0050 1459.7156 97 4850 97 5050 97.4850 97 4950 12385215 Dec 97 5050 97 5350 97 5050 975200 0050 1.653 69 May Currency Futures Japanese Yen (CME) 12:500.000 S per 100 Apr 8998 3070 90 Canarian ICME AD 1000000 CAD 90123 05 10 009 16 10 Using Eigure 141 You are short 10 September 2019 five-year Treasury note futures contracts. Calculate your profit or loss from this trading day (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) Gain/Loss of July 77.62 78.46 -.01 78.18 78.35 77.32 78.73 78.84 78.09 Orange Juice (ICE-US)-15,000 lbs., cents per lb. May 108.90 109.80 108.20 July 113.70 114.35 111.85 108.60 -.80 112.20 -1.95 7.0 5.0 3,9 6.0 3.5 4.2 4.0 10 3,4 Interest Rate Futures Treasury Bonds (CBT)-$100,000; pts 32nds of 100% June 147-280 148-170 147-230 148-070 Treasury Notes (CBT) $100,000; pts 32nds of 100% June 123-190 123-295 123-170 123-255 Sept 123-305 124-040 123-270 124-015 5 Yr. Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 115-160 115-230 115-147 115-202 Sept 115-220 115-252 115-202 115-240 2 Yr. Treasury Notes (CBT)-$200,000; pts 32nds of 100% June 106-123 106-147 106-122 106-136 30 Day Federal Funds (CBT) $5,000,000,100 daily avg. April 97.590 97.593 97 590 97.590 May 97 600 97.600 97 595 97.595 10 Yr. Del. Int. Rate Swaps (CBT) $100.000, pts 32nds of 100% June 104.406 104.797 104,406 104.641 1 Month Libor (CME)-$1300,000; pts of 1004 April 97.5225 Eurodollar (CME)-$1000,000. pts of 1001 April 97 4275 97.4275 974100 97.4175 June 97.4450 97 4550 97 4400 97 4450 Sept 97 4850 97 5050 974850 97 4950 Dec 97 5350 5050 97 5200 002 2005 NN 188 0125 0050 0050 Currency Futures Japanese Yen (CME) +12.500.000 $ per 100% 901 905 3 CO Canadian Dollar CME-CAD 1000.000 per CAD April 7508 750 Settle Chg Open Interest Contract Open High hilo Low Cotton (ICE-US)-50,000 lbs.; cents per b. May 78.18 78.35 77.32 July 78.73 78.84 78.09 Orange Juice (ICE-US)-15,000 lbs.; cents per ib. May 108.90 109.80 108.20 July 113.70 114.35 111.85 77.62 78.46 -47 -01 51,151 81,051 108.60 112.20 -80 -1.95 10.496 7,078 Interest Rate Futures Treasury Bonds (CBT) $100,000: pts 32nds of 100% June 147-280 148-170 147-230 148-070 7.0 941,582 Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 123-190 123-295 123-170 123-255 5.0 3,920.906 Sept 123-305 124-040 123-270 124-015 6.0 2.121 5 Y. Treasury Notes (CBT)-$100,000pts 32nds of 100% June 1 15-160 115-230 115-147 115-202 3.5 4.272,721 Sept 115-220 1 15-252 115-202 115-240 4.0 41.922 2 Yt. Treasury Notes (CBT)-$200,000; pts 32nds of 100% June 106-123 106-147 106-122 106-136 1.0 3,407,265 30 Day Federal Funds (CBT) $5,000,000,100 daily avg. Apr 97.590 97 593 97 590 97 590 002 222.888 97.600 97.600 97.595 97.595 -005 264,957 10 M. Del. Int. Rate Swaps (CBT) $100,000, pts 32nds of 100% June 104.406 104.797 104.406 104.641 188 19.922 1 Month Libor (CME) $1300,000. pts of 100% April 97 5225 15 Eurodollar (CME) $1000,000. pts of 100% April 97.4275 97 4275 97.4100 97-4175 - 0125 225 824 Jane 97 4450 97 4550 97 4400 97 4450 0050 1459.7156 97 4850 97 5050 97.4850 97 4950 12385215 Dec 97 5050 97 5350 97 5050 975200 0050 1.653 69 May Currency Futures Japanese Yen (CME) 12:500.000 S per 100 Apr 8998 3070 90 Canarian ICME AD 1000000 CAD 90123 05 10 009 16 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts