Question: Using equivalence calculations involving multiple formulas (section 4.10) and interest rate of 8%, calculate the present equivalent value in year 0 of the cash flows

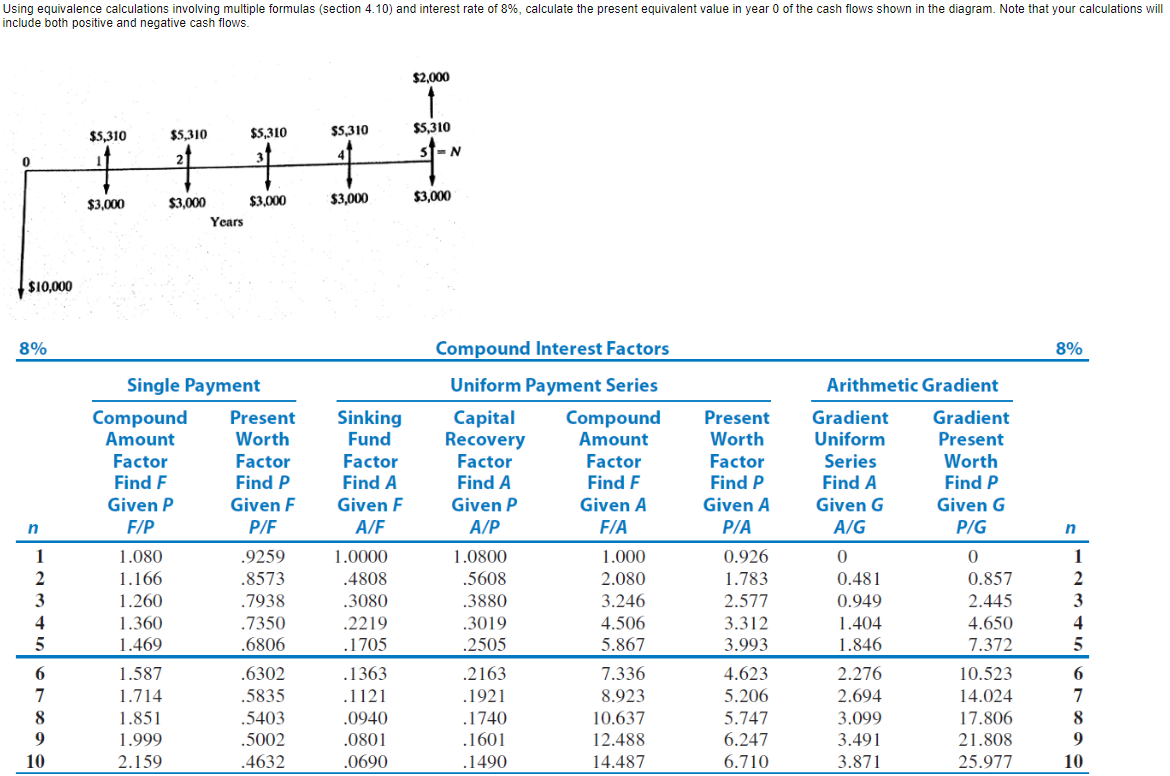

Using equivalence calculations involving multiple formulas (section 4.10) and interest rate of 8%, calculate the present equivalent value in year 0 of the cash flows shown in the diagram. Note that your calculations will include both positive and negative cash flows. $2,000 $5,310 $5,310 $5,310 $5,310 $5,310 SEN $3,000 $3,000 $3,000 $3,000 $3,000 Years $10,000 8% 8 % Compound Interest Factors Uniform Payment Series Single Payment Compound Present Amount Worth Factor Factor Find F Find P Given P Given F F/P P/F Sinking Fund Factor Find A Given F A/F Capital Recovery Factor Find A Given P A/P Compound Amount Factor Find F Given A F/A Present Worth Factor Find P Given A P/A Arithmetic Gradient Gradient Gradient Uniform Present Series Worth Find A Find P Given G Given G A/G P/G GI 0.481 0.949 4 1.404 1.846 1.080 1.166 1.260 1.360 1.469 1.587 1.714 1.851 1.999 2.159 zoavales .9259 .8573 .7938 .7350 .6806 .6302 .5835 .5403 .5002 .4632 1.0000 .4808 .3080 .2219 .1705 .1363 .1121 .0940 .0801 .0690 1.0800 .5608 .3880 .3019 .2505 .2163 .1921 .1740 .1601 .1490 1.000 2.080 3.246 4.506 5.867 7.336 8.923 10.637 12.488 14.487 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 6 0.857 2.445 4.650 7.372 10.523 14.024 17.806 21.808 25.977 2.276 2.694 3.099 3.491 3.871 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts