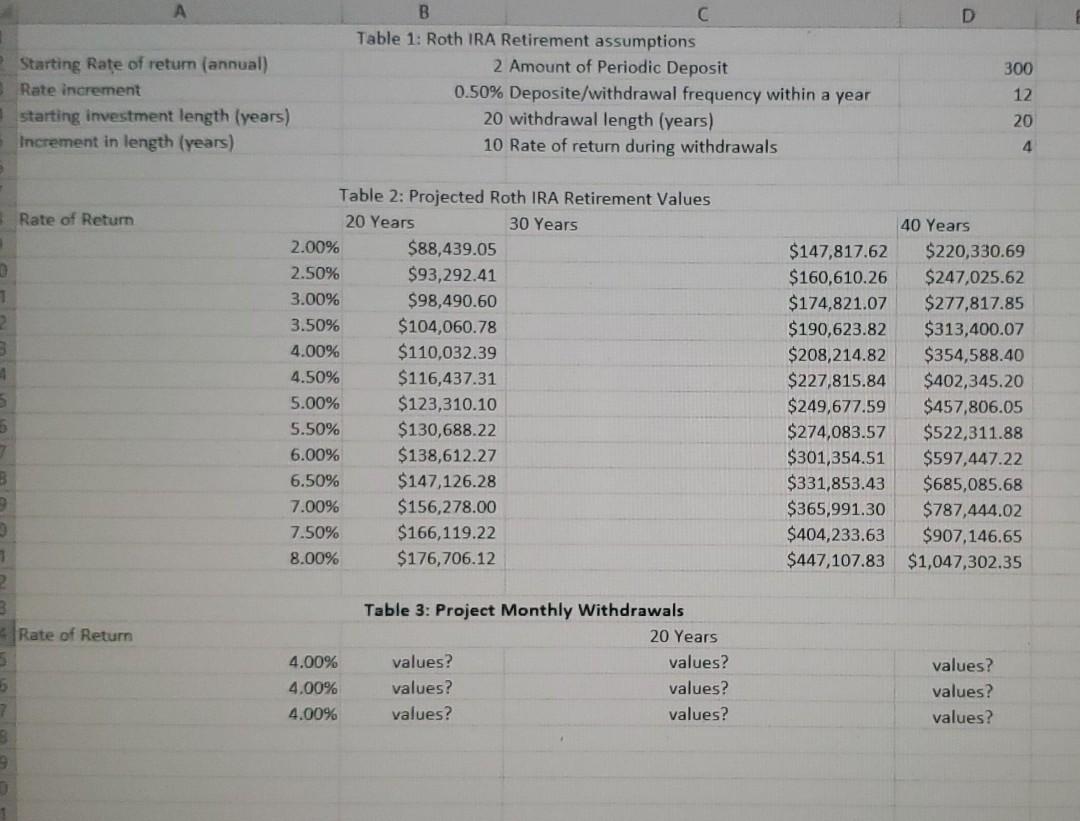

Question: Using Excel answer the following: A.) Create assumptions table 1 that will be used to link with tables 2 and 3, thus providing analysis flexibility.

Using Excel answer the following: A.) Create assumptions table 1 that will be used to link with tables 2 and 3, thus providing analysis flexibility.

B.) Using the numbers from table 2, create table 3 to compare the monthly withdrawals from the potential Roth IRA account balances. The initial plan is to exhaust the account after 20 years and the rate of return on the account is a constant 4.00 percent in all scenarios. However, both numbers may change, and table construction should take this into account.

A D Starting Rate of return (annual) Rate increment starting investment length (years) Increment in length (years) B Table 1: Roth IRA Retirement assumptions 2 Amount of Periodic Deposit 0.50% Deposite/withdrawal frequency within a year 20 withdrawal length (years) 10 Rate of return during withdrawals 300 12 20 4 Rate of Return @ S 4 Table 2: Projected Roth IRA Retirement Values 20 Years 30 Years 2.00% $88,439.05 2.50% $93,292.41 3.00% $98,490.60 3.50% $104,060.78 4.00% $110,032.39 4.50% $116,437.31 5.00% $123,310.10 5.50% $130,688.22 6.00% $138,612.27 6.50% $147,126.28 7.00% $156,278.00 7.50% $166,119.22 8.00% $176,706.12 40 Years $147,817.62 $220,330.69 $160,610.26 $247,025.62 $174,821.07 $277,817.85 $190,623.82 $313,400.07 $208,214.82 $354,588.40 $227,815.84 $402,345.20 $249,677.59 $457,806.05 $274,083.57 $522,311.88 $301,354.51 $597,447.22 $331,853.43 $685,085.68 $365,991.30 $787,444.02 $404,233.63 $907,146.65 $447,107.83 $1,047,302.35 5 Rate of Return Table 3: Project Monthly Withdrawals 20 Years values? values? values? values? values? values? 4.00% 4.00% 4.00% 5 values? values? values? 3 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts