Question: using excel format please answer this question Part 3) Adidas AG, a German multinational, wishes to borrow U.S. dollars at a fixed rate of interest.

using excel format please answer this question

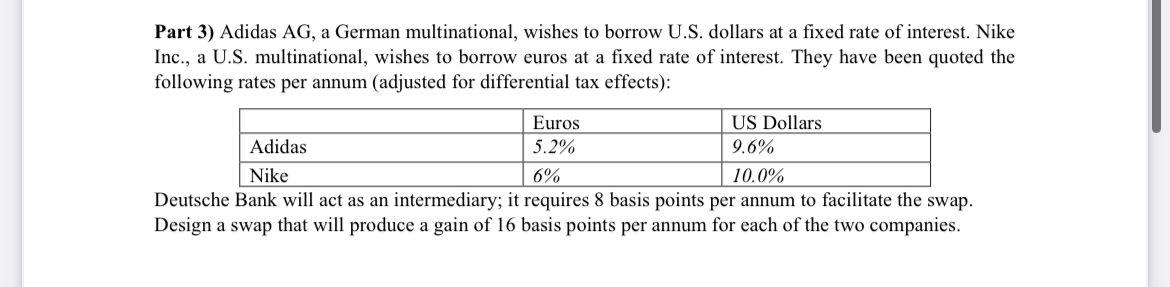

Part 3) Adidas AG, a German multinational, wishes to borrow U.S. dollars at a fixed rate of interest. Nike Inc., a U.S. multinational, wishes to borrow euros at a fixed rate of interest. They have been quoted the following rates per annum (adjusted for differential tax effects): Euros US Dollars Adidas 5.2% 9.6% Nike 6% 10.0% Deutsche Bank will act as an intermediary; it requires 8 basis points per annum to facilitate the swap. Design a swap that will produce a gain of 16 basis points per annum for each of the two companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts