Question: using excel might help a.) The initial cost of constructing a permanent dam (i.e., a dam that is expected to last forever) is $425 million.

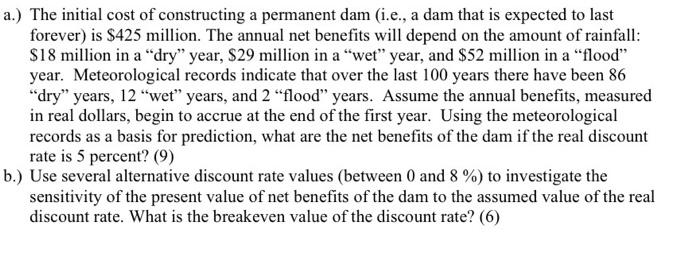

a.) The initial cost of constructing a permanent dam (i.e., a dam that is expected to last forever) is $425 million. The annual net benefits will depend on the amount of rainfall: $18 million in a "dry" year, S29 million in a "wet" year, and $52 million in a "flood" year. Meteorological records indicate that over the last 100 years there have been 86 "dry" years, 12 "wet" years, and 2 "flood" years. Assume the annual benefits, measured in real dollars, begin to accrue at the end of the first year. Using the meteorological records as a basis for prediction, what are the net benefits of the dam if the real discount rate is 5 percent? (9) b.) Use several alternative discount rate values (between 0 and 8 %) to investigate the sensitivity of the present value of net benefits of the dam to the assumed value of the real discount rate. What is the breakeven value of the discount rate? (6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts