Question: using excel please 6-1. (Calculating the future value of an ordinary annuity) Calculate the future value of eatid the following streams of payments. a. 430

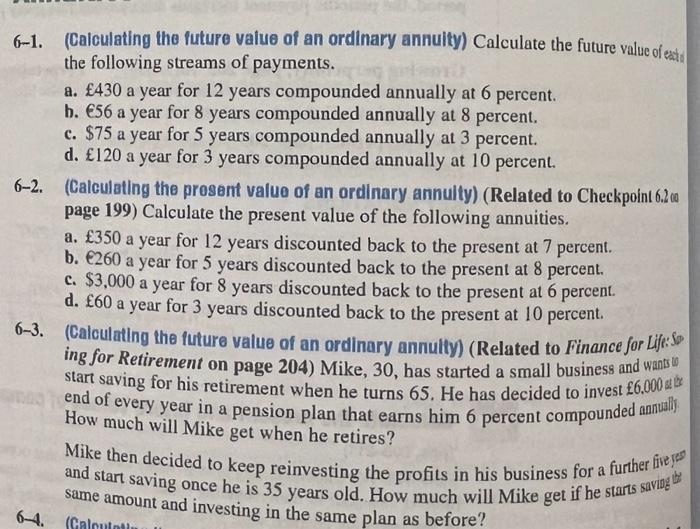

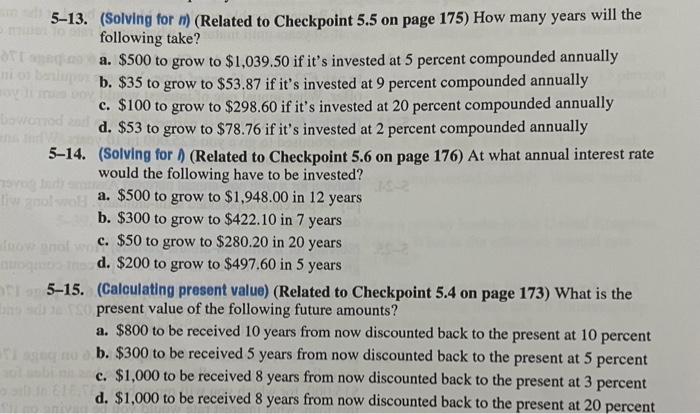

6-1. (Calculating the future value of an ordinary annuity) Calculate the future value of eatid the following streams of payments. a. 430 a year for 12 years compounded annually at 6 percent. b. 56 a year for 8 years compounded annually at 8 percent. c. $75 a year for 5 years compounded annually at 3 percent. d. 120 a year for 3 years compounded annually at 10 percent. 6-2. (Calculating the prosent value of an ordinary annulty) (Related to Checkpoint 6.20 page 199) Calculate the present value of the following annuities. a. 350 a year for 12 years discounted back to the present at 7 percent. b. 260 a year for 5 years discounted back to the present at 8 percent. c. $3,000 a year for 8 years discounted back to the present at 6 percent. d. 60 a year for 3 years discounted back to the present at 10 percent. 6-3. (Calculating the future value of an ordinary annulty) (Related to Finance for Lif:. So ing for Retirement on page 204) Mike, 30, has started a small business and wantiv start saving for his retirement when he turns 65 . He has decided to invest 66.000ed it end of every year in a pension plan that earns him 6 percent compounded annullif? How much will Mike get when he retires? Mike then decided to keep reinvesting the profits in his business for a further fire and start saving once he is 35 years old. How much will Mike get if he starts saviliget same amount and investing in the same plan as before? 5-13. (Solving for n ) (Related to Checkpoint 5.5 on page 175) How many years will the following take? a. $500 to grow to $1,039.50 if it's invested at 5 percent compounded annually b. $35 to grow to $53.87 if it's invested at 9 percent compounded annually c. $100 to grow to $298.60 if it's invested at 20 percent compounded annually d. $53 to grow to $78.76 if it's invested at 2 percent compounded annually 5-14. (Solving for I) (Related to Checkpoint 5.6 on page 176) At what annual interest rate would the following have to be invested? a. $500 to grow to $1,948.00 in 12 years b. $300 to grow to $422.10 in 7 years c. $50 to grow to $280.20 in 20 years d. $200 to grow to $497.60 in 5 years 5-15. (Caloulating present value) (Related to Checkpoint 5.4 on page 173) What is the present value of the following future amounts? a. $800 to be received 10 years from now discounted back to the present at 10 percent b. $300 to be received 5 years from now discounted back to the present at 5 percent c. $1,000 to be received 8 years from now discounted back to the present at 3 percent d. $1,000 to be received 8 years from now discounted back to the present at 20 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts