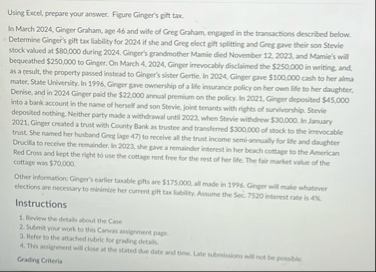

Question: Using Excel, prepare your answer. Figure Ginger's gift tax In March 2 0 2 4 Gineer Graham, age 1 6 and wife of Greg Graham,

Using Excel, prepare your answer. Figure Ginger's gift tax

In March Gineer Graham, age and wife of Greg Graham, engaged in the transactions described below.

Determine Ginger's gift tax liability for if she and Greg elect gitt splitting and Gres guve their son Stevie stock valued at $ during Ginger's grandmother Mamie died November and Mamie's will bequeathed $ to Ginger. On March Ginger irrevocably disclaimed the $ in writing, and. as a vesult, the property powsed inctesd to Gingor's sbter Certie In Ginger pave $ cash to her alma mater, State University. In Ginger give ownership of a life imurance policy on her own lile to her daughtec, Derise, and in Ginger paid the $ annual premium on the policy, In Ginger deporited $ into a bank account in the name of herself and son Stevie, joint teruints with rigits of survivorship. Stevie deposited nothing. Neither party made a withdrawal unta nhen reve with or In lanuary Ginger created a truit with County Bank as trustee and translerred $ of stock to the impocable trust. She named her hurband Geeg age to receive all the trust income semiannualy for life and daughter Drucills to rective the remainder. In she gave a remainder interest in her beach cottage to the American Red Cross and kept the right to use the cottage rent free for the rest of her life. Tie fair malket value of the cottage was $

Other information: Ginger's earlier tarable gifts are $ all made in Giper wall male whatever elections are necem

Instructions

Submit your work to this Camas assigrenent page.

Refer to the attacted fobric for erading detalh.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock