Question: Using Excel: Problem 3: MM has recently approached about the prospect of purchasing a large construction crane. The crane rents for $500 an hour but

Using Excel:

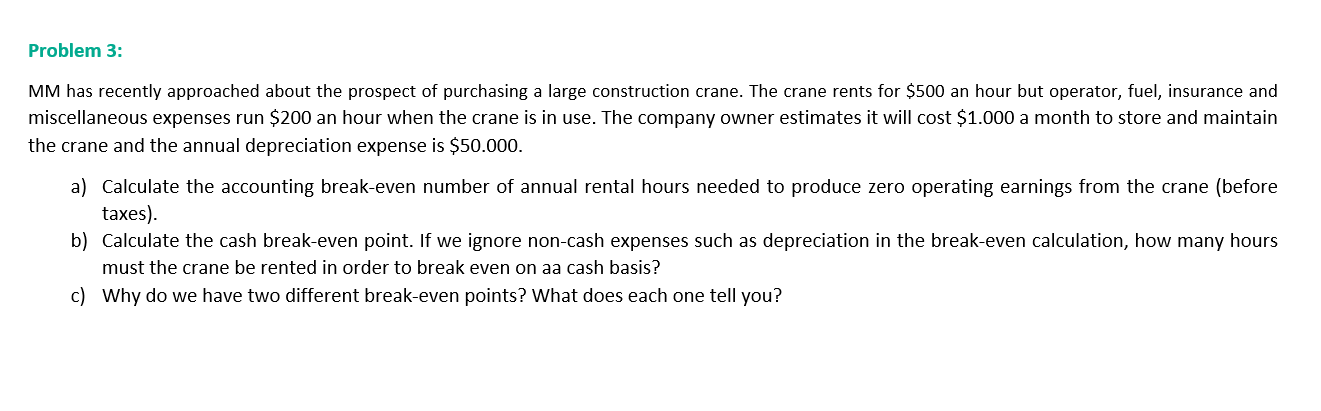

Problem 3: MM has recently approached about the prospect of purchasing a large construction crane. The crane rents for $500 an hour but operator, fuel, insurance and miscellaneous expenses run $200 an hour when the crane is in use. The company owner estimates it will cost $1.000 a month to store and maintain the crane and the annual depreciation expense is $50.000. a) Calculate the accounting break-even number of annual rental hours needed to produce zero operating earnings from the crane (before taxes). b) Calculate the cash break-even point. If we ignore non-cash expenses such as depreciation in the break-even calculation, how many hours must the crane be rented in order to break even on aa cash basis? c) Why do we have two different break-even points? What does each one tell you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts