Question: Using EXCEL ( Show Formula) Fill in cells in the spread sheet to find the call option premium. Double check you answer using the put-call

Using EXCEL ( Show Formula)

- Fill in cells in the spread sheet to find the call option premium.

- Double check you answer using the put-call parity.

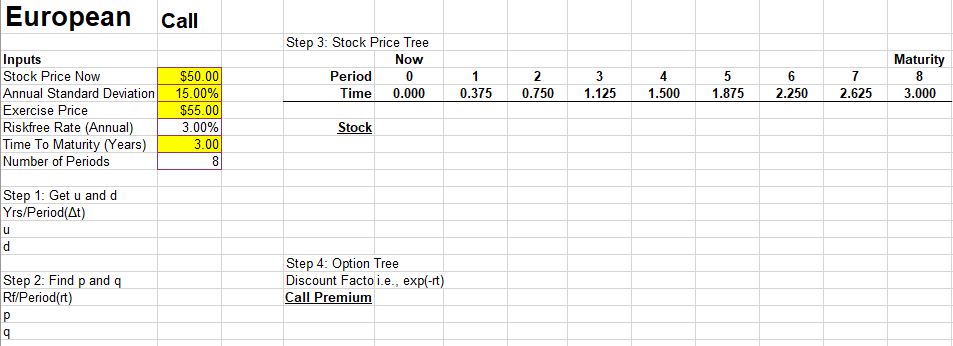

European Call Step 3: Stock Price Tree Now Period 0 Time 0.000 1 0.375 2 0.750 3 1.125 4 1.500 5 1.875 6 2.250 7 2.625 Maturity 8 3.000 Inputs Stock Price Now Annual Standard Deviation Exercise Price Riskfree Rate (Annual) Time To Maturity (Years) Number of Periods $50.00 15.00% $55.00 3.00% 3.00 8 Stock Step 1: Get u and d Yrs/Period(At) u d Step 4: Option Tree Discount Facto i.e., exp(-rt) Call Premium Step 2: Find p and a p Rf/Period(rt) p 9 European Call Step 3: Stock Price Tree Now Period 0 Time 0.000 1 0.375 2 0.750 3 1.125 4 1.500 5 1.875 6 2.250 7 2.625 Maturity 8 3.000 Inputs Stock Price Now Annual Standard Deviation Exercise Price Riskfree Rate (Annual) Time To Maturity (Years) Number of Periods $50.00 15.00% $55.00 3.00% 3.00 8 Stock Step 1: Get u and d Yrs/Period(At) u d Step 4: Option Tree Discount Facto i.e., exp(-rt) Call Premium Step 2: Find p and a p Rf/Period(rt) p 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts