Question: Using excel spreadsheet In Problem 6, how might we determine whether these ratios reflect a well-managed, creditworthy company? (LG 20-4) Use the following financial statements

Using excel spreadsheet

-

In Problem 6, how might we determine whether these ratios reflect a well-managed, creditworthy company? (LG 20-4)

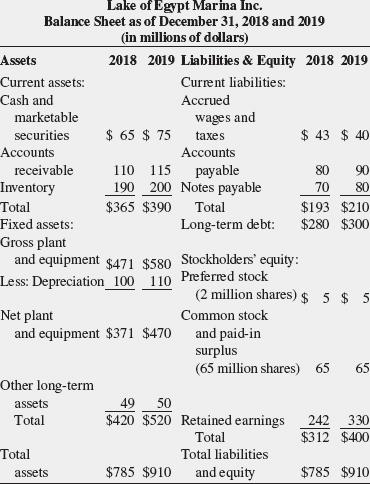

Use the following financial statements for Lake of Egypt Marina to answer Problem 8. (LG 20-4)

| Lake of Egypt Marina Inc. Income Statement for Years Ending December 31, 2018 and 2019 (in millions of dollars) | ||

|

| 2018 | 2019 |

| Net sales (all credit) | $432 | $515 |

| Less: Cost of goods sold | 200 | 260 |

| Gross profits | 232 | 255 |

| Less: Depreciation and other operating expenses | 20 | 22 |

| Earnings before interest and taxes (EBIT) | 212 | 233 |

| Less: Interest | 30 | 33 |

| Earnings before taxes (EBT) | 182 | 200 |

| Less: Taxes | 55 | 57 |

| Net income | $127 | $143 |

| Less: Preferred stock dividends | $ 5 | $ 5 |

| Net income available to common stockholders | 122 | 138 |

| Less: Common stock dividends | 65 | 65 |

| Addition to retained earnings | $ 57 | $ 73 |

please showing formulas in excel

Lake of Egypt Marina Inc. Balance Sheet as of December 31, 2018 and 2019 (in millions of dollars) Assets 2018 2019 Liabilities & Equity 2018 2019 Current assets: Current liabilities: Cash and Accrued marketable wages and securities $ 65 $ 75 taxes $ 43 $ 40 Accounts Accounts receivable 110 115 payable 80 90 Inventory 190 200 Notes payable 70 80 Total $365 $390 Total $193 $210 Fixed assets: Long-term debt: $280 $300 Gross plant and equipment $471 $580 Stockholders' equity: Less: Depreciation 100 110 Preferred stock (2 million shares) $ 5 $ Net plant Common stock and equipment $371 $470 and paid-in surplus (65 million shares) 65 65 Other long-term assets 49 50 Total $420 $520 Retained earnings 242 330 Total $312 $400 Total Total liabilities assets $785 $910 and equity $785 $910

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts