Question: Using excel spreadsheet The following is ABC Inc.s balance sheet (in thousands): (LG 20-5) Also, sales equal $500, cost of goods sold equals $360, interest

Using excel spreadsheet

-

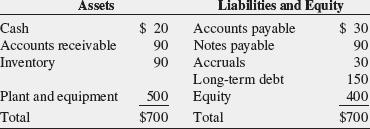

The following is ABC Inc.s balance sheet (in thousands): (LG 20-5)

Also, sales equal $500, cost of goods sold equals $360, interest payments equal $62, taxes equal $56, and net income equals $22. The beginning retained earnings is $0, the market value of equity is equal to its book value, and the company pays no dividends.

-

Calculate Altmans Z score for ABC, Inc. if ABC has a 50 percent dividend payout ratio and the market value of equity is equal to its book value. Recall the following:

Net working capital

=

Current assets Current liabilities

Current assets

=

Cash + Accounts receivable + Inve ntories

Current liabilities

=

Accounts payable + Accruals + Notes payable

EBIT

=

Revenues Cost of goods sold Depreciation

Taxes

=

(EBIT Interest)(Tax rate)

Net income

=

EBIT Interest Taxes

Retained earnings

=

Net income(1 Dividend payout ratio)

-

Should you approve ABC Inc.s application to your bank for $500,000 for a capital expansion loan?

-

If ABCs sales were $450,000, taxes were $16,000, and the market value of equity fell to one-quarter of its book value (assume cost of goods sold and interest are unchanged), how would that change ABCs income statement? With the new data, does your credit decision change?

-

What are some of the shortcomings of using a discriminant function model to evaluate credit risk?

-

please show formulas in excel

Assets Cash Accounts receivable Inventory $ 20 90 90 Liabilities and Equity Accounts payable $ 30 Notes payable 90 Accruals 30 Long-term debt 150 Equity 400 Total $700 Plant and equipment Total 500 $700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts